Singapore’s Economy and Living Standards Report

Gdp and standard of living, cost of living and inflation, unemployment and fiscal policies, works cited.

The Republic of Singapore is an Asian sovereign nation situated one degree north of the equator (Frost and Balasingamchow 5). Several facts explain why Singapore is a unique state. The first one is that the country’s size has been increased by over 23 percent through land reclamation. It is also the “only island city-state in the world” (Heng 102). Singapore’s strategic location on the Asian continent makes it a global finance, business, and transport hub. The country is faring well in terms of education, personal safety, life expectancy, housing, and healthcare. This research paper therefore gives a detailed analysis of the country’s gross domestic product (GDP), demographics, and living standards. Such measures can be used to guide entrepreneurs and investors who want to do business in this country.

Singapore’s Economic Background

Singapore became an independent nation on 21 st September 1965 from Malaysia (Frost and Balasingamchow 23). It would later become a republic on 15 th October the same year. The country’s first president was known as Yusof bin Ishak (Yew 19). The young nation began its struggle in order to prosper and survive without any support from its colonial power. The leaders of the country focused on powerful initiatives to create a sense of consciousness and identity. This goal was critical because Singapore’s original population was composed of immigrants from different locations. In order to survive, the nation’s new strategy focused on its geographical location on the continent.

The president implemented a powerful industrialization program to support economic development. The Jurong Industrial Estate (JIE) was extended under this program (Heng 104). The other issue that was taken seriously was public housing. This move was initiated in order to ensure more people could have their own homes. In 1971, the nation decided to build up superior defense forces. By the year 1972, Singapore had become a politically stable nation with an admirable economic growth. The nation’s economic growth rate from 1965 to 1995 averaged eight percent per annum (Heng 104). This development played a critical role towards improving the citizen’s living conditions.

Towards the end of the 20 th century, Singapore’s GPD per capita stood at 13,000 US dollars. The GDP surpassed that of Israel, Portugal, and South Korea. By 2015, the country GPD per capital was at par with that of Germany. These statistics show conclusively that Singapore has become a highly developed economy. It is currently one of the Four Asian Tigers (Frost and Balasingamchow 89). The other three economies include Hong Kong, Taiwan, and South Korea. The political climate experienced in the country has resulted in a competitive, free, dynamic, and business-friendly economic environment. The level of corruption has remained extremely low within the past two decades. According to many economists, the country’s GDP per capita might surpass the $90,000 US mark by the year 2040. This is a clear indication that Singapore is on the right path towards becoming a fully developed nation.

Demographics

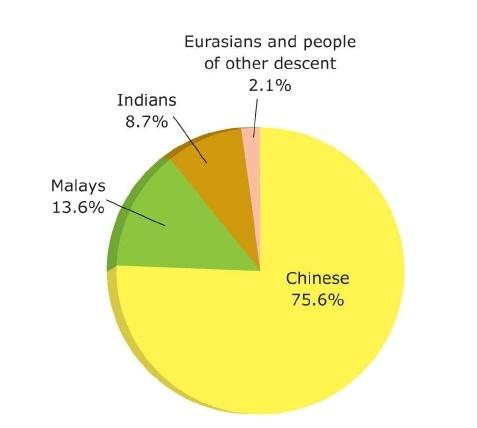

Current statistics indicate that Singapore has an estimated population of around 5.5 million people. This figure includes both citizens and permanent residents. Around 23 percent of the country’s residents are foreign-born. This means that many people in the country come from foreign nations. The latest census conducted in 2010 indicated that over 75 percent of the country’s residents had a Chinese origin. Thirteen percent of “residents were of Malay descent” (Heng 109). The population is also composed of Indians. Ninety percent of the population has permanent residents or homes. The country has over 225,000 workers from foreign countries.

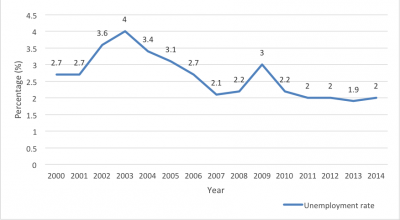

Singapore is one of the nations with a low unemployment rate. Unemployment rate in the country has not exceeded 4 percent since 2004. The rate fell to less than 2 percent in 2015. The median age of the country’s residents is around 39.2 years. The “fertility rate in this country is 0.80 children per woman” (Yew 43). The government encourages foreigners to settle in the country permanently. This strategy has continued to support the country’s population growth. The male to female ratio in the country in 2015 was 50.6:49.4. Many people in the country have post-secondary education. Statistics released in 2015 indicated that over 45 percent of the citizens had completed university education. The percentage of graduates is expected to increase in the coming years.

Gross Domestic Product (GDP)

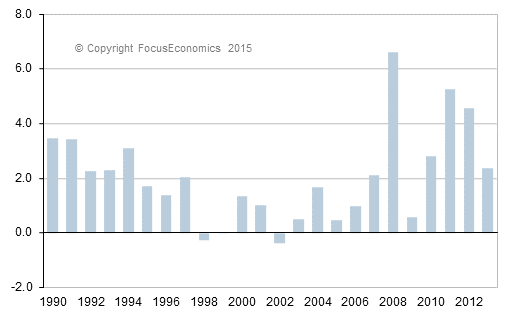

After independence, Singapore faced numerous challenges that affected its economic development pattern. The levels of poverty and unemployment were extremely high during the time. In order to drive economic performance, the government formed the Economic Development Board (EDB). The first objective was to attract more foreign investors. The country’s growth averaged 8 percent from 1960 to 1996 (Yew 92). After the infamous financial crisis that affected the region from 1998 to 1999, the economic growth grew to 9.9 percent.

The gross domestic product (GDP) in the nation was around $292.7 billion 2015. This means that Singapore’s GDP value represents 0.47 percent of the world economy (Heng 104). From 1960 to 2015, the GDP has averaged 70 and 80 USD billion. The GDP peaked to $306.34 billion in the year 2014 (Frost and Balasingamchow 47). The country’s economy is projected to grow steadily in the coming years. The per capita Gross National Income (GNI) in 2015 stood at 69,283 US dollars. A study by Heng indicated that the country’s industrial growth rate was 6.9 percent in 2014 (121).

The other critical economic indicator is the manufacturing sector’s total output. The total output from the sector in 2015 was around $283 billion. The country’s total trade during the same year amounted to $884.1 billion (Pecotich and Schultz 132). The country’s real growth in gross domestic product has therefore outperformed that of Canada, Taiwan, and Australia. This is a clear indication that the economy of this nation has been performing positively within the past decade.

The total economic output of the country is supported by specific industries. In 2014 and 2015, the country’s GDP has been supported mainly by the manufacturing and construction industries. The manufacturing industry commands over 19 percent of the nominal GDP. The services industry is characterized by different sectors such as finance and insurance, information and technology, accommodation, wholesale and retail trade, and business operations (Pecotich and Schultz 19). The services industry therefore represents 70 percent of the nation’s GDP.

Singapore’s has been supporting its economic growth through different trade activities. In 2014, the country’s total trade totaled over 892 billion dollars (Sloman and Wride 38). Its major trade partners include Malaysia and the United States. The country has also been importing different products from countries such as Malaysia, Indonesia, and the Philippines. The agricultural sector contributes a small percentage to the national GDP. The agricultural products common in Singapore include eggs, ornamental fish, copra, rubber, and orchids.

Standard of Living Measures

Quality of life is a powerful framework used to measure the experiences of many people in a specific country or community. It is agreeable that Singapore is one of the smallest nations in the Asian continent. However, it has become one of the best societies to live in across the continent. The citizens in the country are pressured to succeed and achieve their goals in life. A study conducted by ABC News indicated that over 95 percent of the people in the country were happy with its safe and clean environment (Swee-Hock 47). The “nation has been observed to develop a materialistic culture” (Swee-Hock 73).

The first factor that dictates the quality of life in Singapore is its economic environment. The country boasts of an open, corruption-free, and dynamic business environment. The economy has been diversifying within the past three decades. This means that more citizens have access to different products and ideas. The Port of Singapore is a favorite destination for many electronics and consumer goods. The country’s GDP has continued to sustain economic development. The GDP per capita has been growing steadily since the year 1970. In 1985, the country’s GDP per capita was $6,782. By the year 2010, the GDP per capita has increased to $46,569 (Pecotich and Schultz 75). These statistics show clearly that the country’s economic environment continues to support the welfare of many citizens.

Class disparity is Singapore has remained extremely low within the past four decades. In 2000, disparity in family income “increased because higher-income households were earning more money” (Swee-Hock 41). Using the Gini coefficient, the disparity stood at 0.48 in 2000. Statistics indicate that there is no recognizable disparity in racial groups in the nation. The rich and the poor in this country live in the same neighborhoods.

The government has not been measuring poverty in the country. However, households making less than $1,200 are considered poor. It is agreeable that there is no abject poverty in the country. Studies have indicated that there are over 105,000 families that have little income. The other measure of standard of living is the affordability and quality of housing. In 2015, over 82 percent of the country’s population lives in leaseholds managed by the Housing and Development Board (HDB). Public houses are affordable to many citizens in the country. The quality of housing is also acceptable in Singapore (Phang and Helble 16). This is a clear indication that many people lead quality lifestyles.

The citizens and permanent residents in this nation can work for less than 45 hours in order to purchase necessities. Inflation rate in the country has averaged 2.6 percent from 1960 to 2016. The highest rate of 34 percent was recorded in 1974. The other measure is amount of leisure time every year. Statistics indicate that many firms promote the concept of work-life balance. Many people have an average annual leave of 30 days (Phang and Helble 18).

The country’s healthcare system supports the welfare of the citizens. The nation has a world-class health system that embraces modern technologies and competent specialists (Haseltine 37). The Medisave program pays medical expenses for workers in the country. The government offers affordable healthcare services to the needy. There are adequate clinics, pharmacies, and public hospitals that meet the health needs of the population. The drugs sold in different pharmacies are safe. Medical practitioners and physicians are licensed to offer various health services. The healthcare system in Singapore has minimized the prevalence of various diseases. The major diseases affecting the population include diabetes, hypertension, and cancer. The government has been implementing powerful measures to promote a green and clean environment for the population. In 2008, the government spent over 3.9 percent of its GDP on the country’s healthcare (Haseltine 38).

As mentioned earlier, many people in the country have access to quality education. The housing program implemented in the country makes it easier for more people to access quality education. People with disabilities and learning difficulties can attend special schools. This analysis explains why Singapore has a high literacy level. The success of Singapore’s education sector can be attributed to the continuous modification of the syllabus. The required changes are guided by the emerging needs and abilities of the students (Swee-Hock 102). Learners from low-income households can get the scholarships from different institutions. The life expectancy for males is 80.5 while that of females is 84.9 years.

Infrastructure and public services are taken seriously in this country. The government has been focusing on the best initiatives to make Singapore a green island. Such initiatives have led to numerous public parks and quality infrastructure. The people have access to clean air, transport, and quality drinking water. The citizens can purchase a wide range of consumer goods from the increasing number of retail outlets. Singapore’s geographical location explains why it does not experience hurricanes, volcanoes, and earthquakes (Haseltine 82). These statistics support the fact that Singapore is one of the best countries to live in.

Singapore is admired by many people across the globe because of its political stability, affluence, green environment, and business attractiveness. These attributes have continued to attract many tourists and investors. Despite these features, Singapore remains one of the most expensive countries to reside in (Frost and Balasingamchow 37). Low and middle income households have to identify new sources of income in order to meet their basic needs. Statistics also indicate that the income of an individual in the country dictates his or her expenses and spending habits. This discussion gives a detailed analysis of the major indicators of cost of living in this nation. These indicators include exchange, interest, and inflation rates. The discussion also describes the major investment and consumer spending patterns in the country.

Inflation Rates

The positive economic growth pattern recorded in Singapore within the last six decades explains why inflation rate has remained low over the years. After gaining independence in the 1960s, the country has maintained an average inflation rate of 2.66 percent (Frost and Balasingamchow 41). This is a clear indication that the economy has been growing steadily while at the same time supporting the needs of the people. Throughout this period, the highest inflation rate of 34 percent was recorded in 1974 (Yew 73). A record low inflation rate of -3.10 percent was recorded in the year 1976. The initiatives and economic development programs implemented by the government have been playing a positive role towards maintaining a constant inflation rate. This development makes it easier for more people to adjust accordingly and realize their potentials.

The latest rate of inflation recorded in January 2017 was 0.60 percent. The previous inflation rate recorded towards the end of 2016 was 0.20 percent. Experts have indicated that the latest rate is the highest since 2014 (Pecotich and Schultz 93). During the same period, core inflation in the country increased significantly by 1.5 percent. Consumer prices have been increasing steadily in the nation. Core inflation is a powerful index that excludes private transportation and accommodation. The latest rate of 1.5 still remains the highest since 2014. According to experts, inflation in the country is expected to reduce significantly within the next decade. This is the case because the government has implemented powerful measures to ensure the figures remain low. Additionally, the continued use of modern technologies, emerging opportunities, and involvement in international trade will maximize household incomes in the country.

Exchange Rates

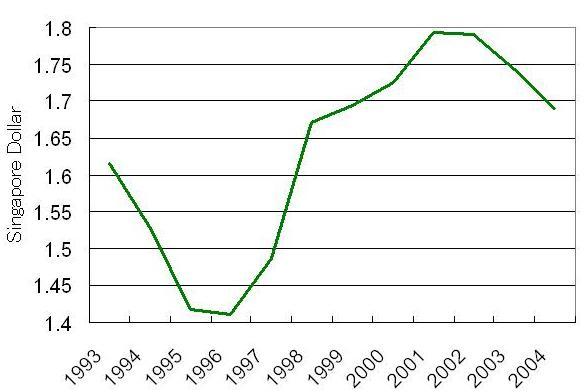

An exchange rate is “a term used in finance and business to denote the rate at which one nation’s currency is exchanged for another” (Yew 53). The official currency of the country is the Singapore dollar (code SGD). The symbol for the currency is S$. The SGD is available in both coins and notes. The coins circulated in the country are in “the values of 1, 5, 10, 20, and 50 cents” (Yew 92). The biggest dollar note in circulation is valued at 10,000 dollars. The currency has been in use since the year 1967.

More often than not, some nations undervalue their currencies in an attempt to reduce the costs incurred whenever exporting various products. The strategy is usually implemented to foster economic performance. A reduced exchange rate in a specific country will ensure more consumers in foreign regions acquire various goods at cheaper prices. Currently, the Singapore dollar is exchanged at $0.708 and 0.576 British pounds (Pecotich and Schultz 102).

The SGD has maintained an average exchange rate since 1990. However, the SGD strengthened from 1994 to 1997. From 1977 to 2002, the value of the SGD started to reduce. Since 2002, new incentives have been implemented by the government to stabilize the Singapore dollar (Yew 53). The same trajectory has been recorded within the past decade. This is the case because the SGD has been becoming stronger against the other major global currencies.

According to economic analysts, the Singapore dollar is projected to stabilize and trade around 1.46 by the end of 2017. Experts use the Autoregressive Integrated Moving Average (ARIMA) model to predict the future performance of currencies. The same figure is also expected from 2018 to 2020 with slight changes. This exchange rate explains why more people strongly believe that the currency is stable and can support the business performance of many people in the country (Sloman and Wride 47). However, specific issues such as economic downturns and unpredictable events might affect these future exchange rate projections.

Interest Rates

One of the widely used strategies to “control a country’s monetary system is monitoring its interest rates” (Sloman and Wride 48). However, the situation is totally different in Singapore since the Monetary Authority of Singapore (MAS) achieves the same goal by managing the SGD’s exchange range. This is done by monitoring the performance of the currencies of the major competitors, emerging economies, and leading trade partners. This strategy has played a significant role towards supporting the performance and business goals of different actors in the country’s economy.

From 1988 to 2017, the average interest rate in Singapore has averaged 1.66 percent. The highest exchange rate of 20% was recorded in the year 1990 (Pecotich and Schultz 32). The lowest rate of -0.75 was recorded in 1993. Deposits in the country’s leading banks earn a low interest of less than 2.0 percent. This percentage has been constant from 2002. Savings accounts earn a small interest of between 0.05 to 0.2 percent (Mukhopadhaya et al. 82). Many people who want to get the best interest rates trade with foreign financial institutions and banks. These foreign banks have been observed to offer admirable rates for deposits in comparison with the leading institutions.

Some banks have extra conditions that must be fulfilled by depositors who want to get better interest rates. Some of these conditions might include maintaining a specific minimum balance or the continued use of credit cards. The other important thing to note is that fixed term deposit interests do not change in the country (Mukhopadhaya et al. 48). These options should be selected wisely by businesspeople, citizens, and investors.

According to financial experts, it can be extremely hard to predict specific measures such as interest rates. However, analysts offer their predictions based on the past financial data and performance. Such analysts have indicated that interest rates will range between 1.9 and 2.5 percent this year. In 2018, an average interest rate of 2.5 percent will be recorded in the country. The rate is expected to shift from 2.5 to 3 percent from 2019 (Yew 192). However, such interest rates might change significantly due to a number of factors such as political climate and future economic performance.

Consumer Spending Patterns

Singapore is a country whose economy is growing very fast. This means that more people have disposable income that can be used to purchase a wide range of consumer products and services. The number of citizens earning better salaries and wages in the region has been increasing steadily since 2011. As a wealthy nation, Singapore continues to record rising expenditures and incomes (Sloman and Wride 102). Consumer spending has averaged 4 percent within the past five years. Similarly, the number of people purchasing new products has continued to increase in this country. These developments and trends explain why Singapore has become one of the most trusted test markets for a wide range of consumer products across the world.

From 2003 to 2012, investments in retail and consumer goods industries grew by over 140 percent (Swee-Hock 89). During the same period, more people continued to embrace new lifestyles. The desire for better lifestyles, improved images, better experiences, and healthy living conditions has increased significantly in the country within the past decade. In order to achieve these goals, many citizens have changed their consumption behaviors and habits.

In the last quarter of 2016, consumer spending in the country increased to 34316 million SGD. Consumer “expenditure has averaged 16549 SGD million since 1975” (Mukhopadhaya et al. 12). Economists have indicated that consumer spending in this country might trend between 37000 and 38000 million SGD from 2018 to 2022 (Mukhopadhaya et al. 129). As one of largest economies today, Singapore is expected to be worth over 340 US dollars by the year 2020. At the same time, the economy is expected to grow by 4.2 percent in the next five years. That being the case, chances are extremely high that consumer spending might grow at an annual rate of six percent (Pecotich and Schultz 22). The spending is expected hit 176 billion US dollars within the next five years. The rapid growth of the middle class, urbanization, emergence of opportunities, and rising incomes will fuel robust consumer spending in the country.

These findings show conclusively that more people in Singapore are finding it easier to afford a wide range of consumer products. This development is attributed to increased salaries, new economic activities, political stability, and availability of quality healthcare services (Mukhopadhaya et al. 53). The growing opportunities and availability of consumer goods will continue to support the projected consumer spending in the country.

Investment Patterns

The proximity of Singapore to the major shipping zones and lanes makes it an attractive investment destination. The government is known to support powerful policies that promote foreign investment and open trade (Heng 118). Foreign direct investment (FDI) is obtained from five major nations. These include the United States, United Kingdom, Switzerland, the Netherlands, and Japan (Pecotich and Schultz 73). The US has the largest share of 11.6 percent. The country’s investment in Singapore is concentrated in a number of sectors such as petroleum, industrial chemicals, electronics, and banking. In order to protect the needs of different investors, the government has implemented several Bilateral Investment Treaties (BITs). Such treaties have continued to protect the interests of different companies and nations (Mukhopadhaya et al. 59).

The other investment trend observed in this country is in the form of aid. Investors and businesspeople benefit from financial assistance provided by various national institutions. The government supports investment ideas especially in the manufacturing and services industries. This measure has been implemented in order to ensure more people have job opportunities in the country. Several opportunities in the country encourage more investors to consider this destination (Pecotich and Schultz 18). The legal frameworks existing in the country make it easier for investors to achieve their goals. The implementation of various privatization programmes continues to support investors in the nation. These opportunities have continued to attract both foreign and private domestic investors.

Statistics show conclusively that investment patterns have been increasing significantly since the 1965. For instance, government investments increased by 23.1 percent from 1965 to 1999 (Frost and Balasingamchow 28). Foreign direct investment from different nations such as Japan and the United States increased by 12.7 percent during the same period. Banks and financial institutions have also been focusing on the new opportunities in the country. Private investors in the country have increased significantly by 21 percent from 1965 to 1999.

Investment patterns in the country are not expected to change in the future. However, some analysts have argued that new incentives and financial assistances will be needed to ensure more people invest in the country. Additionally, the emergence of monopolistic companies and sectors is expected to disorient the current investment patterns experienced in this country (Heng 127). Some of these sectors include legal, telecommunications, and broadcasting. The manufacturing industry is also becoming saturated. Positive investment patterns are expected in the services and retailing industries.

Employability

Singapore’s trade-oriented economic structure has attracted both investors and workers from different parts of the world. The economy is also open to many players due to lack of corruption. Singapore has continued to attract many foreign workers (Mukhopadhaya et al. 9). Studies show conclusively that Singapore has been characterized by full employment for its citizens. The employees also benefit from insurance cover, better remunerations, good working conditions, and allowances. In order to promote industrial relationships, the government of Singapore promotes cooperation between trade unions and employers. The resolution of obstacles and disputes is done in a timely manner. This fact explains why industrial strikes are extremely rare in this nation.

The term employability therefore focuses on the skills that make it easier for an individual to get a job. With proper competencies and skills, employees can find it easier to emerge successful and realize their career objectives (Swee-Hock 18). The nature and effectiveness of Singapore’s education system has played a critical role towards making many people employable. This is the case because many people have attained postsecondary education. The citizens are usually equipped with adequate skills that can support the performance of different industries.

After the country’s independence, many citizens and immigrants did not possess most of the required employability skills. At the same time, the struggling young economy could not absorb the country’s population. Fortunately, the incentives and programs implemented by the new government made it easier for more people to acquire quality education. Many foreign businesspeople began to invest in the country (Swee-Hock 21). Consequently, the people found it easier to get new jobs in different sectors.

Currently, many citizens have access to new employment opportunities because they possess most of the required employability skills. The current wave of technological use is making it easier for more people to identify new job opportunities. The Ministry of Manpower (MOM) has been focusing on various initiatives in order to ensure more people develop desirable employability skills. By so doing, the MOM targets to empower more citizens and make it easier for them to lead quality lifestyles. SkillsFuture is a new initiative implemented in the country to make lifelong learning a powerful concept that supports the needs of more citizens. The initiative will also be used to identify and implement new educational ideas that have the potential to empower more people (Swee-Hock 31). This analysis shows clearly that more Singaporeans will be in a position to offer evidence-based services to different employers in the future.

Unemployment Rate

Unemployment rate in the country has remained extremely low within the past three decades. The highest rate of around 4 percent was recorded towards the end of the 21 st century (Swee-Hock 21). With proper incentives and programs, the government of Singapore has managed to provide new opportunities to both permanent residents and citizens. Unemployment rate reduced significantly from the year 2001 to 2012. The unemployment rate was recorded at 1.9 in 2012.

The government introduced a new scheme known as the Workforce Income Supplement (WIS). The main goal of the program was to support the welfare of many low-skilled laborers in the country. The Special Employment Credit (SEC) has been in place since the year 2011 to ensure more elderly citizens get new jobs (Heng 104). The program has also played a positive role towards ensuring that more people with disabilities can get good paying jobs.

Frost and Balasingamchow indicate that unemployment in the country has averaged 2.42 from the 1980s to 2016 (137). This highest unemployment rate in Singapore was recorded at 6 percent in 1986. The lowest rate in the country was 1.40 percent in 1990. In 2016, unemployment increased from 1.9 to 2.1 percent. This was the highest unemployment rate to be recorded between 2010 and 2016. The latest unemployment rate recorded in January 2017 was 2.2 percent.

Future forecasts indicate that the country’s unemployment rate might have increased slightly by the year 2020. Unemployment rate in Singapore “is expected to stand at 2.2 percent for the next one year” (Heng 129). Using the ARIMA model, economists have projected the country’s unemployment rate to stand at 2.6 percent in 2019. The use of econometric models has gone further to indicate that the unemployment rate will increase within the next decade. This change might be caused by the saturation of different industries and sectors. The increasing population and changing economic patterns might have significant impacts on the country’s unemployment rate.

Government Policies to Reduce Unemployment

Singapore remains one of the best destinations for foreign workers. These workers are attracted to provide labor in the nation. However, the government understands that the increasing number of foreigners can make it impossible for many citizens to get new job opportunities. This problem is therefore tackled using powerful policies that increase the participation of local residents in the labor force (Frost and Balasingamchow 142). Foreign workers are also forced to earn suppressed wages and salaries. This strategy plays a critical role towards dealing with unemployment in Singapore.

The SEC program was implemented in 2011 to ensure unemployed persons such as disabled and older citizens had access to new job opportunities (Heng 106). The SEC scheme also guides employers to re-employ individuals aged 65 years and above. This move explains why many aged persons are still employed.

New policies have been implemented by different ministries such as the MOM. This ministry has been experimenting and analyzing various initiatives that can improve the skills possessed by different citizens. The continuous acquisition of various employability skills can make it easier for many persons to get better jobs. Lifelong learning is embraced by the ministry in order to ensure more people acquire new competencies (Yew 47). This policy has increased the number of employed persons in the country.

The government has continued to attract foreign and local investors in different sectors. This strategy is supported using friendly legal structures and regulations that promote performance. Singapore has also signed new trade agreements with different nations. These initiatives present new opportunities to many citizens. Consequently, more people have been able to get better jobs (Yew 51).

New policies have been implemented in the country whereby younger people can benefit from subsidies. Such individuals will therefore find it easier to get jobs in the country. Such manpower policies also focus on specific skill sets that can benefit more citizens throughout their career lives (Swee-Hock 22). Throughout the years, the government of Singapore has been implementing powerful initiatives to ensure learners acquire quality education. Curriculum is designed in such a way that it supports the emerging issues in the economy. Individuals who benefit from the education system eventually get good jobs.

The government is expected to embrace new policies in the future in order to deal with unemployment. The policies will focus on specific sectors such as labor, education, and technology. Experts believe strongly that a new focus on the role of modern technologies towards promoting economic development will play a unique role towards reducing unemployment (Mukhopadhaya et al 88). Although the country’s unemployment rate might increase steadily in the future, it is agreeable that the implementation of various policies will ensure the levels do not get out of hand.

Fiscal Policies

Singapore’s fiscal policy has always been supported by its tax regime. The purpose of the policy is to achieve four unique objectives that support economic performance. The first one has been to raise enough revenues that can support the government’s expenditures. Tax collection is embraced in an attempt to support and sustain economic development. The fiscal policy is also implemented in order “to promote international tax jurisdiction” (Yew 58). In order to enhance economic growth, the government has been using both indirect and direct taxes.

Since independence, the nation used to rely on direct taxes. Some of these taxes were obtained from personal and corporate earnings. After becoming part of the global business community, Singapore began to focus on indirect taxes obtained from services and goods. The taxes and revenues gained from Goods and Services Tax (GST) continue to support economic development. Over the years, the government has been focusing on a wide range of strategies to minimize revenue volatility. At the same time, such sources of taxes have continued to promote the nation’s fiscal appropriateness and sustainability (Frost and Balasingamchow 163).

By the year 2012, direct taxes were contributing to over 60 percent. The remaining percentage was obtained from indirect taxes. In the recent past, the government of Singapore has been refining and adjusting its fiscal policy in an attempt to achieve a wide range of economic goals. For instance, a progressive system for taxation was implemented in an attempt to promote equitability and efficiency (Frost and Balasingamchow 176). In the year 2013, the government decided to increase taxes on specific higher-end commodities such as luxury cars (Yew 98).

The other critical concern over the years has been the need to ensure Singapore remains the best environment for doing business. Consequently, the government has continued to monitor its fiscal policy in order to ensure “it does not discourage foreign businesses from investing in the country” (Yew 99).

In 2014, the Productivity and Innovation Credit (PIC) was developed as a powerful economic strategy to increase productivity in the nation. The strategy was considered to be one of the best measures to reduce taxes (Pecotich and Schultz 48). The move was supported by economists and experts because of its potential to encourage more companies to invest in the nation. The tax administration department in Singapore plays a crucial role towards ensuring that every player is compliant.

The other critical issue is that the nation has always adhered to “the Standard for Exchange of Information (EOI Standard) for taxation purposes” (Pecotich and Schultz 49). The country has complied with the legal frameworks outlined by the EOI Standard. According to experts, Singapore is expected to continue monitoring and reviewing its tax regime. By so doing, the nation will find it easier to achieve most of its social and fiscal goals. The country has therefore stood firm and remained committed to the guidelines stipulated by the global tax community.

Monetary Policy

This is a sister strategy to fiscal policy and is embraced by central banks to influence the demand and supply of a given country. Monetary policy is usually controlled by the Monetary Authority of Singapore (MAS). The MAS adopts a powerful “interest rate approach whereby interest rates are raised or reduced” (Pecotich and Schultz 72). The strategy has been effective towards dealing with inflations and monitoring consumer goods. Since 1981, the country’s monetary policy has been focusing on the best way to manage exchange rates (Yew 29). The main goal has been to ensure prices remain stable. This approach has played a significant role towards supporting the sustainability of the country’s economy.

Interest rates are usually controlled using direct interventions. The current monetary policy adopted in Singapore is characterized by four unique attributes. The first one is that “the SGD is managed against the performance of the major competitors and trading partners” (Mukhopadhaya et al. 65). The weights of such currencies are revised periodically before adjusting interest rates. The second attribute is that MAS uses a policy band to guide the fluctuations of the Singapore dollar. The strategy caters for short-term fluctuations. The third notable issue is that exchange rates are reviewed to promote constancy and sustainability. The fourth aspect is that domestic rates are usually placed below those of the US.

Within the past 20 years, inflation has averaged 1.9 percent (Mukhopadhaya et al. 71). The use of a powerful monetary policy has continued to promote price stability. The economic measures, business promotion, and financial system are the major strategies that have led to the success of the nation’s monetary policy. That being the case, the policy will remain stable in the next decade and ensure prices are stable.

Frost, Mark, and Yu-Mei Balasingamchow. Singapore: History. Didier Millet Pte Ltd.

Haseltine, William. Affordable Excellence: The Singapore Healthcare Story. Brookings Institution Press, 2013.

Heng, Toh. “Singaporean Economic Development and Peculiar Observations on Saving, Labor Share, Productivity and Current Account Surplus.” Institutions and Economies, vol. 5, no. 2, 2013, pp. 101-130.

Mukhopadhaya, Pundarik, et al. Economic Growth and Income Inequality in China, India and Singapore. Routledge, 2013.

Pecotich, Anthony, and Clifford Schultz. Handbook of Markets and Economies. Routledge, 2014.

Phang, Sock-Yong, and Matthias Helble. “Housing Policies in Singapore.” ADBI Working Paper Series, vol. 1, no. 559, 2016, pp. 1-27.

Sloman, John, and Alison Wride. Economics . Prentice Hall, 2009.

Swee-Hock, Saw. The Population of Singapore. Institute of Southeast Asian Studies, 2012.

Yew, Leong. Asianism and the Politics of Regional Consciousness in Singapore . Routledge, 2014.

- Argentina's Economic Recovery

- US Macroeconomic Indicators in 2005-2012

- Singapore cultures primary mode of subsistence

- Singapore’s and Brazil’s Financial Systems Comparison

- Economic Growth of Singapore from 1965 to 2008

- Expo 2020 as to Impact on UAE Economy

- Chinese Market Crash and Its Impacts on the UK

- Southeast Asia: Energy Security and Economic Growth

- California's Role in American and Global Economies

- Canada's Monetary Policy: Domestic and Global Factors

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2020, September 26). Singapore's Economy and Living Standards. https://ivypanda.com/essays/singapores-economy-and-living-standards/

"Singapore's Economy and Living Standards." IvyPanda , 26 Sept. 2020, ivypanda.com/essays/singapores-economy-and-living-standards/.

IvyPanda . (2020) 'Singapore's Economy and Living Standards'. 26 September.

IvyPanda . 2020. "Singapore's Economy and Living Standards." September 26, 2020. https://ivypanda.com/essays/singapores-economy-and-living-standards/.

1. IvyPanda . "Singapore's Economy and Living Standards." September 26, 2020. https://ivypanda.com/essays/singapores-economy-and-living-standards/.

Bibliography

IvyPanda . "Singapore's Economy and Living Standards." September 26, 2020. https://ivypanda.com/essays/singapores-economy-and-living-standards/.

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

IMAGES

VIDEO