Real Estate Investing & Rental Management | How To

How to Start a House-flipping Business in 7 Steps (+ Free Download)

Published October 18, 2023

Published Oct 18, 2023

REVIEWED BY: Gina Baker

WRITTEN BY: Melanie Patterson

This article is part of a larger series on Investing in Real Estate .

- 1 Prepare a Real Estate Investment Business Plan

- 2 Set Up Your House-flipping Business Operations

- 3 Find Financing Sources for Your House-flipping Business

- 4 Hire the Right House-flipping Professionals

- 5 Identify the Right Properties to Fix & Flip

- 6 Create a Marketing & Lead Generation Plan

- 7 Buy, Rehab, Market & Sell Properties

- 8 Mistakes to Avoid When Starting Your Own House-flipping Business

- 9 Frequently Asked Questions (FAQs)

- 10 Bottom Line

Before taking any house-flipping steps, it’s crucial to lay a strong foundation. This base involves creating a comprehensive business plan encompassing operational setup, team recruitment, property evaluation, securing funds, and the flipping process. To aid in this endeavor, we offer a free template and seven critical steps on how to start a house-flipping business to help you craft a solid strategy and ensure your venture’s success.

If you landed here looking for information on where to find fix-and-flip houses, see our article, How to Find Houses to Flip for Profit in 7 Ways .

1. Prepare a Real Estate Investment Business Plan

Before taking any steps to buying and flipping houses, you need a business plan with specific strategies that pertain to the fix-and-flip business model. A business plan provides a roadmap for how many projects you’ll need to take on, how much profit you need to generate, and funding details that will keep you on track to meet your goals. A clear plan also demonstrates professionalism to lenders and investors when seeking funding.

Complete the following information to get started:

- Write mission and vision statements

- Conduct a SWOT analysis (strengths, weaknesses, opportunities, and threats)

- Set specific and measurable goals

- Write a company summary

- Conduct a market analysis

However, in addition to items from a general investment business plan, a strong house-flipping business plan includes detailed information about this unique business model. Make sure your plan also includes the following:

- Types of properties: Such as single-family homes, duplexes, or multifamily properties.

- Geographic area: The specific locations and neighborhoods where you want to invest.

- Who’ll do the work: Decide if a contractor does the work, you hire a team of specialists, or if you’re doing the work yourself.

- Project timeline: The projected timeline to complete the flip and a six-month margin for inevitable delays.

- Number of projects: How many projects you can realistically manage and complete during the course of one year.

- Financial plan and sources: Define your financing sources and include all costs such as materials, labor, carrying costs (taxes, insurance, utilities, mortgage principal and interest), marketing, and real estate agent commission.

- Expected return on investment (ROI): This figure should include actual calculations, not just a goal. It’s common for flippers to aim for an ROI of 20%. However, returns will vary depending on the location, property values, and the current real estate market conditions.

Use our free template below to write your house-flipping plan and start your business on the right foot:

FILE TO DOWNLOAD OR INTEGRATE

FREE House Flipping Business Plan Template

Thank you for downloading!

2. set up your house-flipping business operations.

While many think flipping houses is solely about buying, renovating, and selling, it’s crucial to establish the proper business foundation for long-term success. This step involves choosing the correct legal entity, like an LLC, registering your business, and creating separate bank accounts. Consulting professionals, such as attorneys and accountants, ensure you set up your entity correctly. Proper business operations keep your enterprise organized, efficient, and legally compliant.

Choose the Right Business Entity

When launching your house-flipping business, selecting the appropriate legal structure and registering it with your state creates a separation between your personal and business assets—safeguarding you in case of business-related liabilities. For instance, if someone gets injured during a demolition, they can sue your company. Still, it creates a hedge from them suing you personally.

Common entity types for investing in real estate include DBA (doing business as), S Corp (subchapter or small business corporation), LLC (limited liability company), and sole proprietorship (the lowest form of legal protection). You must consult with your accountant and attorney as part of your learning how to start a house-flipping business to determine the best fit for your business since this also ties into your financial situation and varies by person.

Read our guide on How to Start a Real Estate Holding Company in 6 Steps for more details.

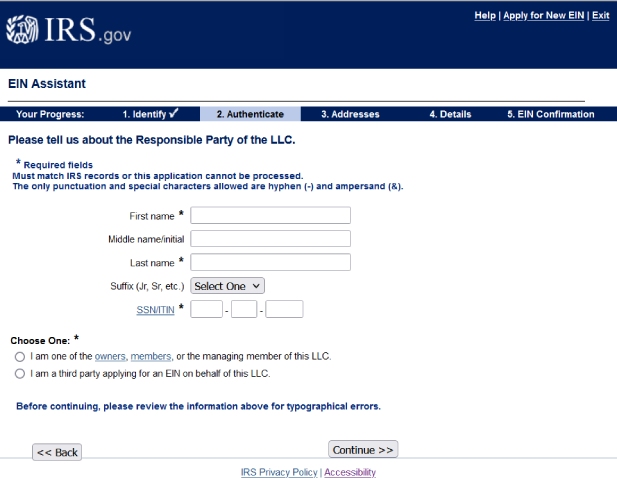

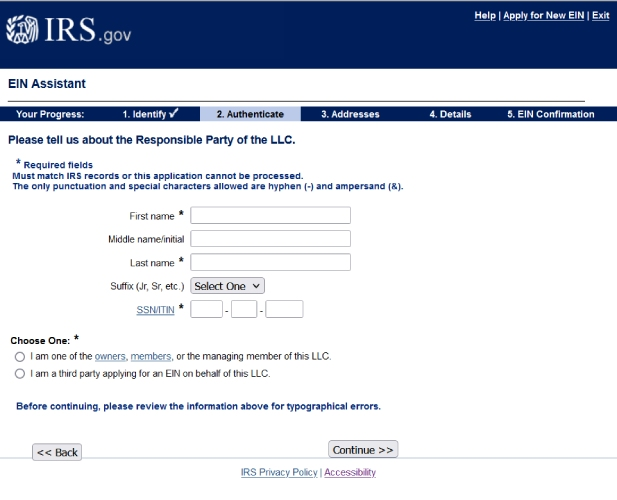

Register Your Business With the IRS & Obtain Permits

Apart from your legal business entity, you must register your business with the Internal Revenue Service (IRS) and get an employee identification number (EIN) . An EIN identifies it as a business entity. Make sure to also check with your state and local municipality for what other business licenses and permits you may need, such as building permits, change of use, or special exceptions to zoning ordinances.

Conveniently apply online (Source: U.S. Internal Revenue Service )

Open a Business Bank Account

With your EIN, you can open a business bank account . Keeping your personal and business money separate is essential to protecting your livelihood and staying legally compliant. Having this account up and running is crucial when starting a flipping business.

For example, you’ll be spending money on gas when looking for properties; all business expenses should come from the same account. You also need to pay your newly hired attorney and accountant. Managing your business account and costs will eliminate auditing from the IRS and complications when your accountant does your taxes.

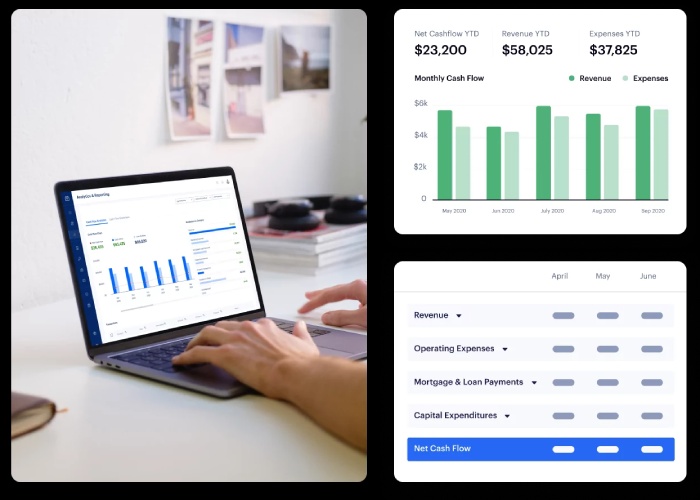

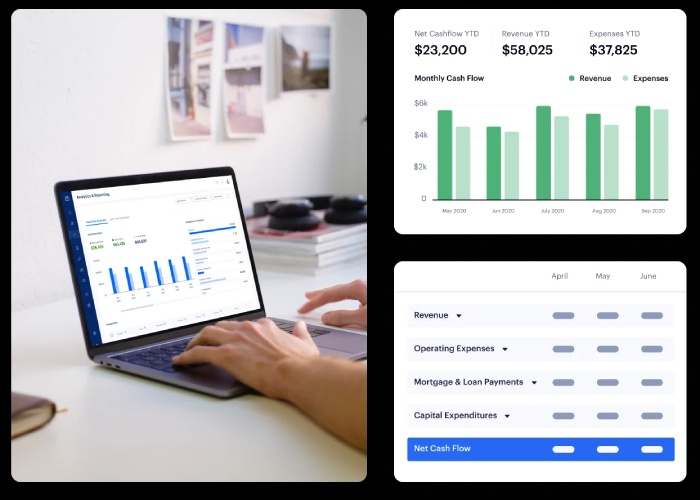

Analytics in the Baselane dashboard (Source: Baselane )

With Baselane’s analytics and reporting capabilities, gain real-time insights into your property’s performance, such as cash flow, profit and loss (P&L), capital expenditures, carrying expenses, and transfers. Streamline the consolidation of your investment property’s financial data from both your business banking and external accounts, all within a single, user-friendly platform.

Visit Baselane

Pro tip: Once your business bank account is up and running, consider applying for a business credit card —a valuable tool for acquiring building materials and office supplies without any upfront costs. Some business credit cards offer perks like cash back, which saves on your upfront costs. Some provide a 30-day to 18-month interest-free period, allowing you to manage expenses more effectively.

3. Find Financing Sources for Your House-flipping Business

A common question in house flipping is how to begin with no money. While you’ll need some funds to buy properties, many flippers don’t use cash for the entire process. They typically secure financing through hard money lenders or specialized loans for house flippers.

The two most common ways to get into the flipping homes business are:

- Hard money loans : These loans offer faster approval and funding times than traditional mortgages. The borrower qualifications are more lenient but with shorter loan terms and higher interest rates.

- Rehab loans: These include home equity lines of credit (HELOCs), HomeStyle renovation mortgages, 203(k) rehab loans, or CHOICERenovation loans. They require a lower down payment but also have more extensive criteria and paperwork.

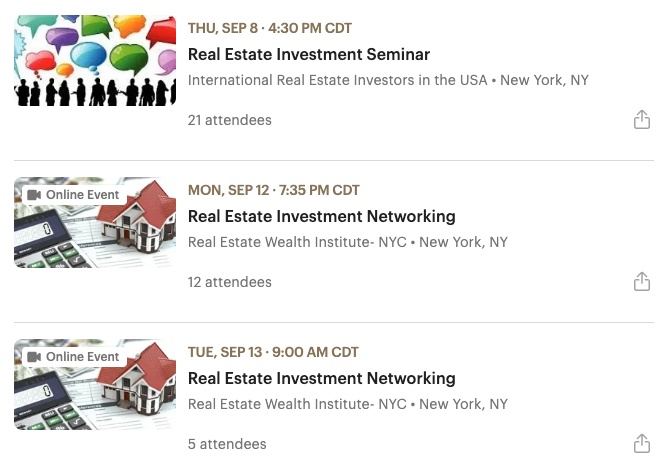

If you have a construction or real estate background, you can join investment groups and find investors willing to put up some cash. It’s easy to find local events and groups for investors by searching on Google or Meetup.com.

Real estate investor groups (Source: Meetup )

Remember that the costs to flip a house vary depending on the individual property, its condition, prices of repairs, and the real estate market. Learning how much money you need to flip a house and how much money you can make by flipping houses can be complex. Still, getting the right financing and maximizing your profits is necessary.

Creating a budget and calculating each project is an important part of your house-flipping checklist. Use the free house-flipping calculator to generate your potential profits when shopping and evaluating potential properties.

4. Hire the Right House-flipping Professionals

When starting as a house-flipper, remember the significance of your professional network for your business plan. Flipping houses isn’t a solo venture; you’ll collaborate with experts like lawyers, accountants, real estate agents, and contractors. These professionals provide valuable insights and guidance for successful house flips, making the difference between a lucrative investment and a costly mistake.

Some important house-flipping pros to hire include:

- Real estate attorney: Manages legal aspects, ensures compliance with local laws, and drafts contracts.

- Accountant: Helps with business structure, filing house-flipping taxes , expense tracking, and financial advice.

- Real estate agent: Offers industry insights, local connections, and accurate market data.

- General contractor (GC): Oversees rehabs, ensuring quality and reducing errors.

- Administrative assistant: Assists with tasks and project management as your business grows.

- Handyperson: Handles smaller jobs, saving time and costs.

- Landscaper: Enhances curb appeal for higher ROI.

- Architect (for large projects): Ensures structural integrity and avoids costly issues.

The most trusted way to find experts is through referrals. Suppose other real estate investors or agents in your network succeeded with a professional. In that case, it’s more likely that you’ll also have a smooth experience with them. However, you should still check them out and vet them with an interview or meeting to ensure you choose the right professionals. In the long run, spending time and effort to choose an expert saves you time, money, and stress.

Pro tip: Building and utilizing your network is crucial for success in house flipping. A strong network can connect you with the right professionals, making it easier to find deals and resources. Your network provides valuable insights, market knowledge, and support from experienced individuals who can guide you through the process and help avoid common pitfalls. Additionally, networking can lead to partnerships and opportunities for collaboration, enabling you to scale your house-flipping business effectively.

5. Identify the Right Properties to Fix & Flip

Before jumping into a purchase, begin by evaluating potential properties to flip. Run a comparative market analysis (CMA) on properties or have a real estate agent run one to determine the value and calculate the return on investment (ROI). Evaluate each property within its neighborhood, location, and real estate market context.

When learning how to find houses to flip , some essential factors to evaluate include:

- Location: Pick nearby properties for easy site visits.

- Neighborhood: Choose desirable neighborhoods for curb appeal.

- Amenities: Houses near parks, schools, and other establishments attract buyers.

- Structural issues: Avoid costly structural problems.

- Value-add repairs: Research profitable upgrades like kitchens and bathrooms.

- Property size: Focus on square footage over the floor plan.

- Outdoor space: Properties with outdoor areas tend to yield higher returns.

Did you know? The potential return on investment (ROI) in a house-flipping business can be significant. Investors purchase distressed properties at a lower cost, renovate them to increase their market value, and then sell them at a higher price, resulting in a profit. ROI percentages vary widely, but successful flips can yield returns ranging from 10% to 100% or even more of the initial investment , depending on location and other factors. However, house flipping comes with risks, such as unexpected renovation costs or market fluctuations, so thorough research and proper planning are crucial to maximize ROI and minimize potential losses.

6. Create a Marketing & Lead Generation Plan

Setting up a successful house-flipping business involves some marketing and real estate branding. While a complex marketing funnel isn’t necessary initially, a well-crafted marketing strategy ensures a steady influx of new projects for your house-flipping business.

Marketing Your Fix & Flip Business

Having foundational marketing elements is crucial for projecting professionalism, building your reputation as a reliable home flipper, and marketing your newly renovated properties, especially if you seek funding. Lenders see your professionalism and experience as favorable.

Consider starting your business with these marketing elements:

Logo: A quality logo distinguishes your brand and is useful across future marketing materials.

Business cards: Affordable and handy for networking; consider adding QR codes for website access.

Website: A simple, one-page site effectively communicates your identity, services, and contact information.

Gmail business email account. (Source: Google Workspace )

Business email: Use your website domain for a professional email address, boosting your image.

Business card templates (Source: Canva )

As you dive into house flipping, consider expanding your marketing with tools like social media and email campaigns. Canva, a versatile and user-friendly design platform, offers templates for various needs, from social media posts to postcards and letterheads. It’s a go-to tool for business owners, making it easy to create diverse marketing materials, both digital and print.

Visit Canva

Lead Generation Strategies for Your Business

Additionally, you will need to consistently generate potential renovation projects and motivated sellers. Many beginners use listing platforms like Zillow to find houses to flip, which offers versatile search filters to refine property searches based on your chosen criteria.

Homeowners opting to sell without agents often use FSBO.com (For Sale By Owner), Craigslist, or Facebook Marketplace. Foreclosed and bank-owned properties typically appear on websites like Foreclosure.com or the government’s HUD Homes site. These properties are appealing to investors for their potential to offer significant discounts and investment opportunities. Generate leads and learn how to find cheap houses to flip, start with the following resources:

7. Buy, Rehab, Market & Sell Properties

Once you have all the right business strategies and structures in place, the bulk of your work as a house flipper comes to buying, renovating, and selling properties. As soon as you close on your property, you’ll have monthly carrying costs that can add to your planned expenses. Therefore, the more efficiently you can complete the flip, the higher your profits.

The process of making money flipping houses goes like this:

- Close on the investment property: Buying an investment property is different than purchasing a primary home, so make sure you know how to determine a budget, evaluate properties, and choose the right lender. Depending on your financing, closing on the property can take 15 to 45 days.

- Make all repairs, renovations, and upgrades: Repairing a fix-and-flip property will take the most time. You or your general contractor should manage the timeline, remembering that delays increase your carrying costs.

- Market the property for sale: There are endless ways to generate excitement about your property and increase the sale price.

- Sell the property: Working with a real estate agent is often the most efficient way for flippers to sell their properties since they manage communications with the buyer’s agent and lender and often schedule the necessary appointments. However, many flippers choose to get a real estate license to gain access to the MLS and save even more on fees.

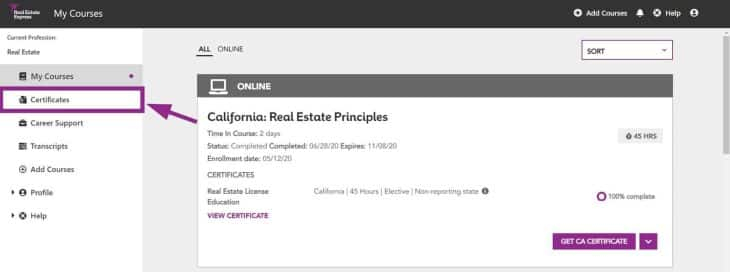

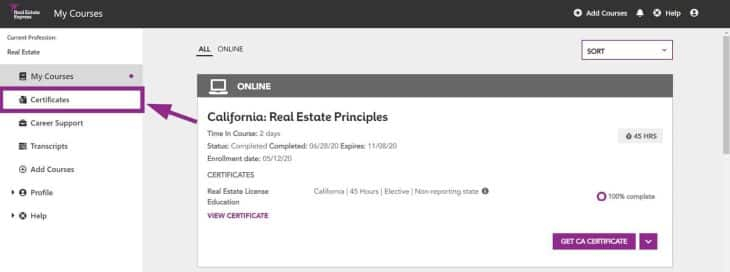

Course platform (Source: Colibri Real Estate )

Experienced house flippers often handle their property transactions to reduce expenses. You can conveniently pursue a real estate license through online schools like Colibri Real Estate, which offers comprehensive courses, instructor support, e-books, live Q&A sessions, and exam prep tools with a pass guarantee. Colibri Real Estate, an accredited education provider, has assisted countless agents and brokers nationwide in obtaining their licenses, enhancing profit opportunities.

Visit Colibri Real Estate – Use Promo Code: FSB30 for 30% off

Mistakes to Avoid When Starting a House Flipping Business

Every beginner inevitably makes mistakes while building their business. For house flippers, there are some definite learning curves, and every new project presents unique challenges. However, the more mistakes you can avoid in the beginning, the more efficiently you’ll be able to build your flipping business and generate a strong ROI.

Some mistakes to avoid when flipping houses include:

- Overestimating your abilities: Avoid taking on major electrical work or plumbing tasks if you lack the necessary skills. It can lead to costly mistakes.

- Lacking a team: House flipping often requires collaboration with contractors, real estate agents, and other professionals. Trying to do it all alone can lead to delays and errors.

- Overspending on renovations: Going over budget can eat into your profits. Plan carefully and prioritize cost-effective improvements.

- Buying a flip far away: Distance can make managing the project effectively and promptly responding to issues challenging.

- Not understanding the numbers: Accurate financial calculations are crucial. Failing to grasp costs and potential profits can result in financial setbacks.

- Being unprepared for the unexpected: House flips often encounter unexpected issues, such as hidden structural problems. Have a contingency plan and budget for surprises.

Frequently Asked Questions (FAQs)

What is the 70% rule in house flipping.

Real estate investors use the 70% rule in house flipping to determine the maximum purchase price for a property to ensure a profitable flip. According to this rule, investors should not pay more than 70% of the property’s after-repair value (ARV) minus the estimated repair and carrying costs.

How much money do you need to start flipping houses?

The initial capital needed for house flipping varies due to location, property type, and your specific flipping houses business plan. Generally, having access to $20,000 to $50,000 is a good starting point. This budget should encompass property purchase, renovation, carrying costs (like taxes and utilities), and contingencies for surprises. Access to financing options, such as loans or partnerships, can also affect your capital requirements.

How many houses a year can you flip?

The number of houses you can reasonably flip in a year depends on various factors, including your experience, team, resources, and local market conditions. On average, experienced house flippers may aim for two to five flips yearly. Beginners may start with one to two flips annually. Scaling beyond these numbers often requires a well-established operation, access to financing, and efficient project management.

Bottom Line

Learning how to start a house-flipping business begins with a strong business plan. It also starts by setting up the right legal and financial systems to set yourself up for success as the business grows. Successful home flippers also create a network of professionals to get their flips done properly and implement strategic marketing and lead generation systems. After following this step-by-step guide, your house-flipping business will be ready to generate strong profits.

About the Author

Find Melanie On LinkedIn

Melanie Patterson

Melanie is a contributing real estate expert at Fit Small Business and the editor of our sister site, The Close, specializing in real estate business development for new and seasoned agents, property managers, and real estate investors. She has over 30 years combined experience in real estate sales, marketing, property management, and investing and is a licensed real estate agent in NH & MA.

By downloading, you’ll automatically subscribe to our weekly newsletter.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Start a House-Flipping Business: Your Essential Toolkit

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If you've tuned into HGTV lately, it won't come as a shock to learn that more people than ever are interested in how to start a house-flipping business. For enterprising investors who aren’t afraid of hard work, flipping a house is an exciting opportunity for short-term investment and for starting a new business. But there’s a lot of research to be done, plus financing and resources you need before you can start a house-flipping business yourself.

So we’re all on the same page here, house flipping is the process of purchasing distressed, foreclosed, or otherwise desirably priced property with the intent to fix it up and sell at a higher price within a short period of time.

»MORE: Read how to fix up that first property you're flipping

If you’re one of those enterprising investors who want in, you’ll need to know more about how to start a house-flipping business. Follow this guide to help you develop a business strategy, plus determine and execute the optimal financing plan.

Starting a house-flipping business in 8 steps

If you’re determined to invest in short-term real estate and flip a house, here’s where to start:

Step 1: Write a business plan

Before taking any action, financial or otherwise, it’s crucial that writing a business plan is the first step in starting your own house-flipping business. A business plan will be key to keeping your business on track, helping you estimate profits, and getting investors.

Your business plan should be fairly in-depth and there is a lot of information you should be sure to include in it. You can either write it on your own or use a business plan template to help you. No matter what you choose, you should be sure to include the key parts of a business plan.

You'll want to start out with an executive summary detailing the purpose of your business, the vision you have for it, some high-level financial projections and identify who will be involved in the business. The rest of the business plan should include a section on the competition and the demand for your business. After all, you need to be sure that there's enough demand to sustain your house-flipping business—a lack of demand for a small business is the reason 42% of small businesses don't make it. That's a group you don't want to be a part of simply because you didn't do your research before starting your business.

You should also use your business plan to lay out what exactly your business will do and how much it will cost, along with how much you expect to make. With house flipping, you'll want to detail how much money you have, how much you expect to need to buy properties and flip them, and then how much you expect to make back.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Step 2: Grow your network

Flipping houses is tough work, and you'll need a plethora or resources to help you finish each job. Identify the resources already available to you to take full advantage of your strengths. Experience in the real estate business, access to a network of excellent craftspeople, or just a promising property are all assets.

Talk to friends or relatives involved in real estate investment, particularly in the area where you plan to invest in property. Anecdotal evidence and word-of-mouth advice can help you find reputable wholesalers, contractors, and realtors to help you find and complete jobs within budget.

Reach out to your existing professional or personal network to find contacts within the industry, and seek out experts for mentoring and advice. Get active in local real estate investment groups or find your chapter of REIClub to connect with industry professionals.

Step 3: Choose a business entity

In order to operate your house-flipping business legally, you'll need to choose a business entity and register your business with the state in which you plan to operate. While there are many business entity types to choose from, you will want to opt for one with limited liability protection, such as an LLC or corporation.

Liability protection is especially important for a house-flipping business because there are many opportunities for things to go wrong. If someone sues your company over an issue with a property you flipped, you'll want to make sure your personal assets are protected. If you're unsure which entity is right for your business, consult a business attorney to help you weigh your options.

Step 4: Obtain an EIN, insurance, permits, and licenses

Registering your business is the first step to legally establish your operation, but there are a few more steps to take to make sure you're officially allowed to start work as a house flipper. First, you should register for an employer identification number, also known as an EIN. Think of this as a socials security number for your business, which you will use for tax purposes, as well as when applying for business loans or a business bank account or credit card. Applying for an EIN can be done online through the IRS website.

Next, you'll want to look into your business insurance options. If you hire employees, you'll need workers compensation, unemployment, and disability insurance. Beyond those policies, you should also look into general liability and commercial property insurance to protect yourself, your business, and your properties.

Finally, you'll need the proper business licenses and permits to operate your business. The licenses and permits you need will depend on your state and the scope of work you're doing; however, you can expect to need several permits when working in the construction business. Check with your local chamber as commerce and consult with your business attorney to make sure you have all the paperwork you need before you start any work.

Step 5: Find suppliers and contractors

Once your business is legally established, it's time to find contractors and suppliers to help you get your business going. Even if you plan to contribute sweat equity to your house-flipping business, you’ll probably need additional contractors to complete a project successfully. Look for contractors with a portfolio of demonstrable work, references, and positive feedback from previous projects.

A trusted general contractor can also look over any remodeling plans and budget projections you make to check for accuracy with regard to cost and timeliness. Finding suppliers who are reliable and can work within your budget is also incredibly important. Tap into your network and do your research to find some reputable options.

Step 6: Assemble a team

Whether you plan on bringing in a partner, hiring outside contractors, or renovating each property yourself, you’ll need to recruit a team of qualified people to complete a successful flip. In particular, consider sourcing for these roles, which could really help you keep things organized and get the most out of your investment:

Business partners or investors

A good potential partner might be an active private investor in your personal network or a real estate investor looking for a project manager. A good business partner brings an asset or skill to the relationship—be it capital resources, skilled labor, industry expertise, or simply a great work ethic and determination to make an honest profit.

According to Jamell Givens, a partner and real estate investor at Leave the Key Homebuyers, the advantage of having a business partner is the ability to evaluate a deal in different ways. Whereas one partner might think only of a home's profit potential, the other might bring local knowledge or connections with contractors.

Realtors or property owners

A background in real estate and property ownership is a huge plus in the house-flipping business. An experienced partner can help you search efficiently for prospective properties, identify the most valuable improvements for a given area, and navigate contracts and sales once the rehabilitation is complete.

Or, if you know a homeowner looking to sell and willing to loan you the money for necessary repairs and renovations, owner or seller financing may work for you.

Legal counsel

Seeking legal advice about any financial agreement or contractual obligation is a good idea, especially when you’re considering making major investments and buying property.

Step 7: Obtain financing

You’ve found a partner, done your research, and maybe even identified the first property you want to flip. In other words, you’re ready to finance your house-flipping business’s first fix-and-flip.

If this is the beginning of your house-flipping career, you’re probably not going to be eligible for a traditional bank loan. Typically, banks only approve businesses with many years of profitability under their belts. And in house-flipping, time is money. That makes the best fix-and-flip loans short-term financing option—usually around 12 months. Repayment terms on bank loans, on the other hand, can run between five and seven years.

That said, you do have a wide variety of fix-and-flip loans available to you. As a brand-new business, you also have a good option to tap into your personal funds or investments. It’s a little risky to throw your own skin in the game—in other words, your nest egg—but it’s likely that your business doesn’t have the revenue and financial stability that most lenders want to see before extending you a business loan .

As always, it’s wise to explore all of your possible options before settling on a loan that best suits your needs. Start your search with these options for new house-flipping businesses:

Friends and family loan

Many rookie real estate investors fund their first projects with personal loans from partners, friends, or family members. If the loan is comfortably within the lender’s means, this alternative to a bank or private loan can alleviate some of the pressure of a traditional loan, as well as ensure a degree of accountability.

If a friend or family member is an investor or partner in your house-flipping project, it’s a good idea to establish terms of the arrangement in writing as soon as you reach an agreement.

Tap into your 401(k)

For first-time flippers with a retirement plan who are not planning to retire in the near future, one financing possibility is taking out a loan from your 401(k). This option incurs the risk of losing your nest egg, which is always a scary prospect. But financing a business with a 401(k) might be the only viable option for entrepreneurs just starting out—and if you’re smart with starting your house-flipping business, you can hopefully make back the cash and then some.

There are two main options for 401(k) loans: The classic 401(k) loan, in which the IRS allows you to borrow up to half the vested balance, or $50,000, whichever is amount is lower; or a ROBS . You’ll determine which type of financing makes the most sense for you based on the size of your investment and your willingness to dip into your retirement savings.

Combination financing

Many experienced short-term real estate investors find success using multiple financing sources to purchase and renovate a property. Depending on your own capital, a partner or investor, and external lenders, it’s likely that you’ll end up using a combined solution to finance your house flipping business.

Step 8: Source your deal

The success of flipping a home depends in large part on supply and demand in the local real estate market, as well as the cost of labor and value appreciation of the renovations.

Identifying your target property market might help you decide if a real estate wholesaler, auction, or a traditional broker is the right choice for your project. If you’re interested in distressed or foreclosed properties, a wholesale broker or auction will have higher volumes of properties available. A traditional broker might be right for you if the real estate market is new to you or if you need help finding a specific type of property or building.

Determine the scope of renovations or rehabilitation you are equipped to complete on a property, keeping in mind the duration and amount of your fix-and-flip loan.

Follow these best practices for a successful house-flipping business

Once you develop a business strategy, assemble a team, identify a property, and secure financing, it’s time to start implementing your renovation plans, thinking about marketing and selling the property , and generally getting your house-flipping business underway. Make sure you:

Commit to your business plan. Planning, logistics, and administrative organization will make or break your project—although you have the potential to make a big, quick profit, starting a house-flipping business is no walk in the park. You’ll need to scout properties, calculate renovation costs, source a trustworthy crew, possibly apply for a small business loan… not to mention the curveballs that may arise with every step.

Approaching the process with a detailed business plan in hand will help keep you on track. And the more confident you are in your business strategy and execution plan, the more adaptable you’ll be to those unpredictable circumstances that’ll inevitably arise.

Grow your network. Use your first fix-and-flip project to foster relationships with industry professionals—from investors to realtors to carpenters—whose collaboration and skills you will need for your next house flip. Experienced contractors and agents can connect you with other vendors, give you leads on properties and service-providers, as well as provide advice on specific projects. Trusted contacts in the industry can also help you cover your blind spots, and make sure estimates for properties and repairs are accurate, saving you time and money.

Make estimates—then double them . Unless you’re already in possession of a property, sufficient cash, and experience with home repairs, the process of flipping a home will require timelines and cost estimates at every turn.

Err on the side of caution when making any projections about the cost and duration of the renovation. That’s especially important if you’re financing your startup with outside investors who need to see that you’ve done your due diligence before putting their own capital on the line.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

- Buyer Agent 101

- Listing Agent 101

- Getting Your License

- Open Houses

- Stats + Trends

- Realtor Safety

- Social Media

- Website Marketing

- Referral Marketing

- Property Marketing

- Branding + PR

- Marketing Companies

- Purchasing Leads

- Prospecting

- Paid Advertising

- Generate Listings

- Generate Buyer Leads

- Apps + Software

- Lead Gen Companies

- Website Builders

- Predictive Analytics

- Brokerage Tech

- Building a Brokerage

- Recruiting Agents

- Lead Generation

- Tech Reviews

- Write for Us

All products mentioned at The Close are in the best interest of real estate professionals. We are editorially independent and may earn commissions from partner links.

How to Start a House Flipping Business in 7 Steps

Jealie is a staff writer and expert on real estate education, lead generation, marketing, and investing. She has always seen writing as an opportunity to apply her knowledge and express her ideas. Over the years and through her internship at a real estate developer in the Philippines, Camella, she developed and discovered essential skills for producing high-quality online content. See full bio

- Prepare a Real Estate Investment Business Plan

- Set Up Your House Flipping Business Operations

- Find Financing Sources

- Hire the Right House Flipping Professionals

- Identify the Right Properties to Fix & Flip

- Create a Marketing & Lead Generation Plan

- Buy, Rehab, Market & Sell Properties

- Mistakes to Avoid

- Bringing It All Together

Before diving into the exciting world of house flipping, starting with a solid foundation is essential. This means putting together a detailed business plan that covers everything from getting your operations set up and building your team to evaluating properties and securing funds for your projects. To make this easier, I have a free template and seven essential steps on how to start a house flipping business. This way, you’ll create a robust strategy that sets you up for success! 🏚️🔨🏠

1. Prepare a Real Estate Investment Business Plan

Before you jump into the fun adventure of buying and flipping houses, creating a business plan outlining your specific success strategies is a good idea. This plan will serve as your roadmap, helping you figure out how many projects you want to take on, the profits you aim to make, and the funding details that will keep your journey on track. A clear business plan for flipping houses shows lenders and investors that you’re professional and serious about your goals.

Use our real estate investment business plan and complete the following information to get started:

- Executive summary

- Company description or overview

- Mission and vision statement

- Investment strategy

- Market analysis

- SWOT analysis

- Specific and measurable goals

- Financial plan

- Budget and financial projections

- Marketing plan

- Real estate team members and technology systems

- Exit strategy

However, besides items from a general investment business plan, a strong house flipping business plan includes detailed information about this unique business model. Make sure your plan also includes the following:

- Types of properties: Such as single-family homes, duplexes, or multifamily properties

- Geographic area: The specific locations and neighborhoods where you want to invest

- Who’ll do the work: Decide if a contractor does the job, you hire a team of specialists, or if you’re doing the work yourself

- Project timeline: The projected timeline to complete the flip and a six-month margin for inevitable delays

- Number of projects: How many projects you can realistically manage and complete during the course of one year

- Financial plan and sources: Define your financing sources and include all costs such as materials, labor, carrying costs (taxes, insurance, utilities, mortgage principal, and interest), marketing, and real estate agent commission

- Expected return on investment (ROI): This figure should include actual calculations, not just a goal. It’s common for flippers to aim for an ROI of 20%. However, returns will vary depending on the location, property values, and the current real estate market conditions.

2. Set Up Your House Flipping Business Operations

Many believe flipping houses is just about buying, renovating, and selling. However, laying down a solid business foundation for lasting success is essential! This means picking the proper legal structure, like an LLC, registering your business, and setting up separate bank accounts. Don’t hesitate to contact professionals, such as attorneys and accountants, who help you set everything up right. With exemplary business practices, you’ll keep your venture organized, efficient, and legally compliant.

Choose the Right Business Entity

When starting your house-flipping business, picking the proper legal structure and registering it with your state is vital. This helps keep your personal and business assets separate, which is helpful if any business-related issues arise. For example, if someone gets hurt during a demolition, they could sue your company, which wouldn’t put your personal assets at risk.

When it comes to investing in real estate , there are a few common entity types you might consider, like DBA (doing business as), S corporation (subchapter or small business corporation), or LLC (limited liability company). Chatting with your accountant and attorney while you’re getting the hang of how to start a house flipping business is a good idea. They determine which option suits you best, as everyone’s financial situation differs.

Register Your Business With the IRS & Obtain Permits

If you’re starting your legal business, one of the first steps is registering with the Internal Revenue Service (IRS) and obtaining an Employer Identification Number (EIN). This number will help identify your business entity. Check with your state and local government to see what other licenses or permits you might need, like building permits or any special exceptions regarding zoning.

Open a Business Bank Account

Once you have your EIN, set up a business bank account to separate your personal and business finances. This protects your hard work and helps you stay compliant with the law, especially when starting a flipping business. You’ll use this account for expenses like gas while scouting properties and paying your attorney and accountant. Managing your expenses in one place will simplify tax time and help you avoid any IRS complications.

With Baselane’s analytics and reporting tools, you can easily track your property’s performance in real time. Get the scoop on cash flow, profits and losses, capital expenses, carrying costs, and transfers all in one place. It makes it simple to gather your investment property’s financial information from your business bank and other accounts on a single, easy-to-use platform.

Pro Tip: Once your business bank account is up and running, consider applying for a business credit card—a valuable tool for acquiring building materials and office supplies without any upfront costs. Some business credit cards offer perks like cash back, which saves on your upfront costs. Some provide a 30-day to 18-month interest-free period, allowing you to manage expenses more effectively.

3. Find Financing Sources for Your House Flipping Business

Many people wonder how to start a house flipping business without any cash. While you’ll need money to buy properties, most flippers don’t rely solely on their funds. They usually find financing through hard money lenders or loans made just for flipping houses. The two main ways to dive into the house-flipping game are:

- Hard money loans : These loans offer faster approval and funding times than traditional mortgages. The borrower qualifications are more lenient but with shorter loan terms and higher interest rates.

- Rehab loans: These include home equity lines of credit (HELOCs), HomeStyle renovation mortgages, 203(k) rehab loans, or CHOICERenovation loans. They require a lower down payment but also have more extensive criteria and paperwork.

The costs of flipping a house can vary a lot depending on the property, its condition, and the market. Figuring out your budget and potential profits can be tricky, but it’s essential for success. Keeping track of your finances and each project is a must in the house-flipping process.

4. Hire the Right House Flipping Professionals

Remember how important your network is for your house flipping business plan. You won’t be going it alone; you’ll work with lawyers, accountants, real estate agents, and contractors. Their insights are key to turning a profit and avoiding costly mistakes. Some important house-flipping pros to hire include:

- Real estate attorney: Manages legal aspects, ensures compliance with local laws, and drafts contracts

- Accountant: Helps with business structure, filing house flipping taxes, expense tracking, and financial advice

- Real estate agent: Offers industry insights, local connections, and accurate market data

- General contractor (GC): Oversees rehabs, ensuring quality and reducing errors

- Administrative assistant: Assists with tasks and project management as your business grows

- Handyperson: Handles smaller jobs, saving time and costs

- Landscaper: Enhances curb appeal for higher ROI

- Architect (for large projects): Ensures structural integrity and avoids costly issues

The best way to find trustworthy experts is by getting referrals. If other real estate investors or agents you know have had great experiences with someone, chances are you’ll have a smooth ride, too. Still, it’s an excellent idea to do some digging and meet with them to ensure they’re the right fit for you. Ultimately, putting in the time and effort to find the right expert can save you a lot of hassle, cash, and stress down the road.

5. Identify the Right Properties to Fix & Flip

Before making a purchase, evaluate potential properties to flip. Run a comparative market analysis (CMA) on properties or have a real estate agent run one to determine their value and calculate the return on investment (ROI). When learning how to find houses to flip, some essential factors to evaluate include:

Did You Know? A house-flipping business’s potential return on investment (ROI) can be significant. Investors purchase distressed properties at a lower cost, renovate them to increase their market value, and then sell them at a higher price, resulting in a profit. ROI percentages vary widely, but successful flips can yield returns ranging from 10% to 100% or even more of the initial investment, depending on location and other factors. However, house flipping comes with risks, such as unexpected renovation costs or market fluctuations, so thorough research and proper planning are crucial to maximize ROI and minimize potential losses.

6. Create a Marketing & Lead Generation Plan

Setting up a successful house-flipping business involves some marketing and real estate branding . While a complex marketing funnel isn’t necessary initially, a well-crafted marketing strategy ensures a steady influx of new projects for your house-flipping business.

Marketing Your Fix & Flip Business

Having foundational marketing elements is crucial for projecting professionalism, building your reputation as a reliable home flipper, and marketing your newly renovated properties, especially if you seek funding. Lenders see your professionalism and experience as favorable. Consider starting your business with these marketing elements:

- Logo: A quality logo distinguishes your brand and is useful across future marketing materials.

- Business cards: Affordable and handy for networking; consider adding QR codes for website access.

- Website: A simple one-page site effectively communicates your identity, services, and contact information.

- Business email: Use your website domain for a professional email address, boosting your image.

Lead Generation Strategies for Your Business

To find renovation projects and motivated sellers, beginners often utilize platforms like Zillow with versatile filters for property searches. In addition, Foreclosure.com is a valuable website for finding discounted properties for foreclosures. Start generating leads and learn how to find cheap houses to flip using these resources:

7. Buy, Rehab, Market & Sell Properties

Once you’ve nailed down the right business strategies and sorted the structures out, most of your work as a house flipper boils down to buying, fixing, and selling properties. After you close on a property, you’ll start racking up monthly carrying costs, which can really add to your planned expenses. So, the quicker and smoother you can get the flip done, the more profit you’ll make.

The process of making money flipping houses goes like this:

- Close on the investment property: Buying an investment property differs from purchasing a primary home, so make sure you know how to determine a budget, evaluate properties, and choose the right lender. Depending on your financing, closing on the property can take 15 to 45 days.

- Make all repairs, renovations, and upgrades: Repairing a fix-and-flip property will take the most time. You or your general contractor should manage the timeline, remembering that delays increase your carrying costs.

- Market the property for sale: There are endless ways to generate excitement about your property and increase the sale price. For some ideas, read our Clever Real Estate Marketing Ideas . Although these strategies are aimed at agents, they are equally effective for home flippers.

- Sell the property: Working with a real estate agent is often the most efficient way for flippers to sell their properties since they manage communications with the buyer’s agent and lender and often schedule the necessary appointments. However, many flippers choose to get a real estate license to gain access to the MLS and save even more on fees.

Experienced house flippers often handle their property transactions to reduce expenses. Pursue a real estate license through online schools like Colibri Real Estate, which offers comprehensive courses, instructor support, ebooks, live Q&A sessions, and exam prep tools with a pass guarantee. Colibri Real Estate, an accredited education provider, has assisted countless agents and brokers nationwide in obtaining their licenses, enhancing profit opportunities.

Mistakes to Avoid When Starting a House Flipping Business

Everyone starting out in the business is bound to mess up a bit. For house flippers, there are some real learning curves, and each new project comes with its unique challenges. But if you can steer clear of some common mistakes right off the bat, you’ll find it a lot easier to grow your flipping business and rake in the profits. Some mistakes to avoid when flipping houses include:

- Overestimating your abilities: Avoid taking on major electrical work or plumbing tasks if you lack the necessary skills. It can lead to costly mistakes.

- Lacking a team: House flipping often requires collaboration with contractors, real estate agents, and other professionals. Trying to do it all alone can lead to delays and errors.

- Overspending on renovations: Going over budget can eat into your profits. Plan carefully and prioritize cost-effective improvements.

- Buying a flip far away: Distance can make managing the project effectively and promptly responding to issues challenging.

- Not understanding the numbers: Accurate financial calculations are crucial. Failing to grasp costs and potential profits can result in financial setbacks.

- Being unprepared for the unexpected: House flips often encounter unexpected issues, such as hidden structural problems. Have a contingency plan and budget for surprises.

What is the 70% rule in house flipping?

Real estate investors use the 70% rule in house flipping to determine the maximum purchase price for a property to ensure a profitable flip. According to this rule, investors should not pay more than 70% of the property’s after-repair value (ARV) minus the estimated repair and carrying costs.

How much money do you need to start flipping houses?

The initial capital needed for house flipping varies due to location, property type, and your specific house flipping business plan. Generally, having access to $20,000 to $50,000 is a good starting point. This budget should encompass property purchase, renovation, carrying costs (like taxes and utilities), and contingencies for surprises. Access to financing options, such as loans or partnerships, can also affect your capital requirements.

How many houses a year can you flip?

The number of houses you can reasonably flip in a year depends on various factors, including your experience, team, resources, and local market conditions. On average, experienced house flippers may aim for 2 to 5 flips yearly. Beginners may start with one to two flips annually. Scaling beyond these numbers often requires a well-established operation, access to financing, and efficient project management.

What do you need to flip houses?

Successfully flipping houses takes a good grip on the real estate scene, a solid game plan, and enough cash for buying and fixing up properties. You’ll want to build a trustworthy crew, including real estate agents and contractors, and make sure you can dedicate some time to the whole process. Having smart marketing tactics for selling the house and knowing the local rules is super important, too. Plus, connecting with folks in the industry can open up some great opportunities and insights.

Learning how to start a house flipping business begins with a strong business plan. It also starts by setting up the right legal and financial systems to set yourself up for success as the business grows. Successful home flippers also create a network of professionals to get their flips done correctly and implement strategic marketing and lead generation systems. After following this step-by-step guide, your house-flipping business will be ready to generate substantial profits.

Please comment below if you have any tips or experiences about your house-flipping journey!

Jealie is a staff writer and expert on real estate education, lead generation, marketing, and investing. She has always seen writing as an opportunity to apply her knowledge and express her ideas. Over the years and through her internship at a real estate developer in the Philippines, Camella, she developed and discovered essential skills for producing high-quality online content.

No Comments Yet

Add comment cancel reply.

Your email address will not be published. Required fields are marked *

Related articles

Free rent receipt templates & when to use them.

Rent receipts are great for tracking payments and serve as proof for landlords and tenants.

6 Ways to Find Probate Leads & Purchase Probate Properties

Probate leads are worth exploring if you want to expand your portfolio and score properties at excellent rates.

Landlord Guide: How to Write a Late Rent Notice Template

Let’s be real: life can throw some curveballs that may prevent your tenant from paying their rent.

Success! You've been subscribed.

Help us get to know you better.

House Flipping Business Plan

- Free Business Plan Download

- Do you need a Formal Business Plan?

- Why write a Business Plan?

- Components of a Business Plan

Executive Summary

- Organizational Structure and Team

- Strategies and Processes

- Company Goals

- Keys to Success

Download Our House Flipping Business Plan Template

Reason # 1 To Map Out the Future of Your Business

Reason # 2 to create a plan of action, reason # 3 to set quantifiable revenue & profit goals, reason # 4 to get funding from business partners & lenders.

- Organizational Structure, Team & Operations Plan

- Business Systems & Processes

- Business Goals & Strateges

Organizational Structure

Business entity & structure.

Talk About Yourself

Talk about your team.

Business Strategies & Processes

Market strategy, targeting your ideal house flip, leads & acquisition strategies.

Deal Due Diligence

Project Management Strategies

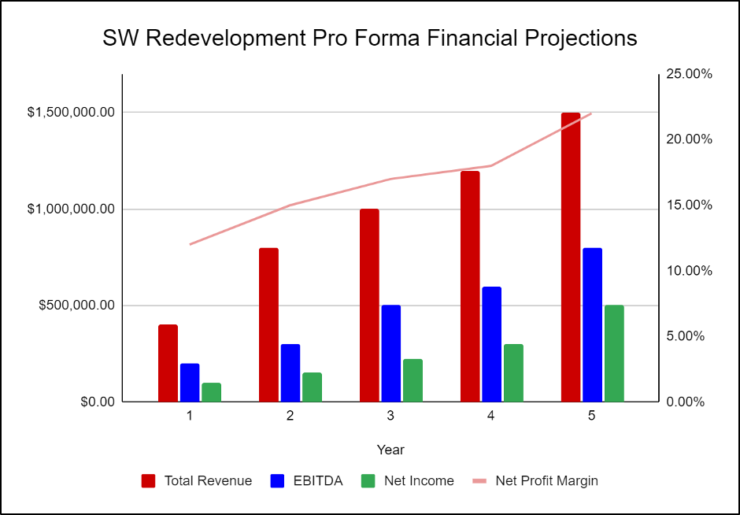

Business Goals & Forecasts

3 to 5 year financial plan, project goals.

Revenue Goals

Profit goals, keys to success and meeting your goals, project team/strategic hires, strategic partnerships/relationships, business systems, ready to take action.

We earn commissions if you shop through the links below. Read more

House Flipping Business

Back to All Business Ideas

How to Start a House Flipping Business in 13 Steps

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on February 11, 2022

Investment range

$31,550 - $64,100

Revenue potential

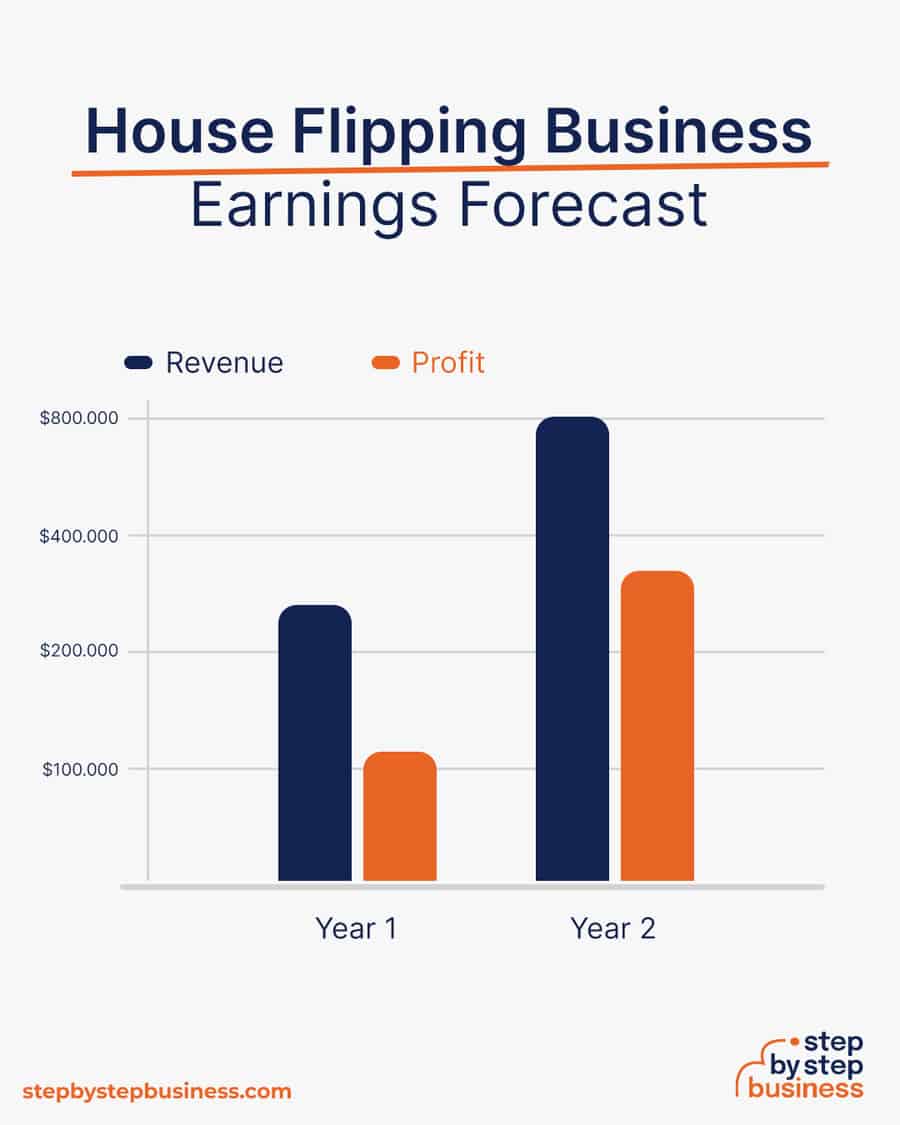

$270,000 - $800,000 p.a.

Time to build

1 – 3 months

Profit potential

$110,000 - $320,000 p.a.

Industry trend

Pay attention to these important factors as you establish your house-flipping business:

- Funding — Secure funding for your house-flipping projects. This could include personal savings, bank loans, hard money lenders, private investors, or partnerships.

- Find properties — Use multiple channels to find properties, including real estate agents, foreclosure auctions, real estate investment groups, online listings, and direct mail campaigns.

- Contractor team — Build a reliable team of contractors, including general contractors, electricians, plumbers, painters, and landscapers. Ensure they are licensed, insured, and have good references.

- Permits and inspections — Get necessary permits for renovation work and ensure all work complies with local building codes and regulations. Schedule inspections as required.

- Register your business — A limited liability company (LLC) is the best legal structure for new businesses because it is fast and simple. Form your business immediately using ZenBusiness LLC formation service or choose one of the top services available .

- Legal business aspects — Register for taxes, open a business bank account, and get an EIN .

- Renovation plan — Create a renovation plan that maximizes the property’s value while staying within budget. Focus on improvements that offer the highest return on investment (ROI), such as kitchen and bathroom upgrades, curb appeal enhancements, and modernizing outdated features.

- Project management — Implement a project management system to track progress, manage timelines, and ensure the renovation stays on schedule and within budget.

Interactive Checklist at your fingertips—begin your house flipping business today!

Step 1: Decide if the Business Is Right for You

Pros and cons.

Starting a house-flipping business has pros and cons to consider before deciding if it’s right for you.

- Cash Cow – Big chunks of income from sales

- Low Labor – Buying and selling require little work

- Flexibility – Run the business from home on your time

- Build Homes — Help families achieve their dreams with a new home

- Risky – With old homes, unexpected problems often get expensive

- Commissions – Realtor commissions cut into profits

House-flipping industry trends

The US real estate market is worth a massive $200 billion, nearly double its value a decade ago.(( https://www.ibisworld.com/industry-statistics/market-size/real-estate-sales-brokerage-united-states/ )) More than 5% of all home sales in 2021 were flipped homes, according to real estate data curator ATTOM.(( https://www.attomdata.com/news/most-recent/attom-year-end-2021-u-s-home-flipping-report/ ))

This means that house-flipping is alive and well, in spite of government regulations designed to discourage house flipping. These regulations came about because some think that flipping artificially inflates prices, which is thought to be a factor in the housing crash of 2008.

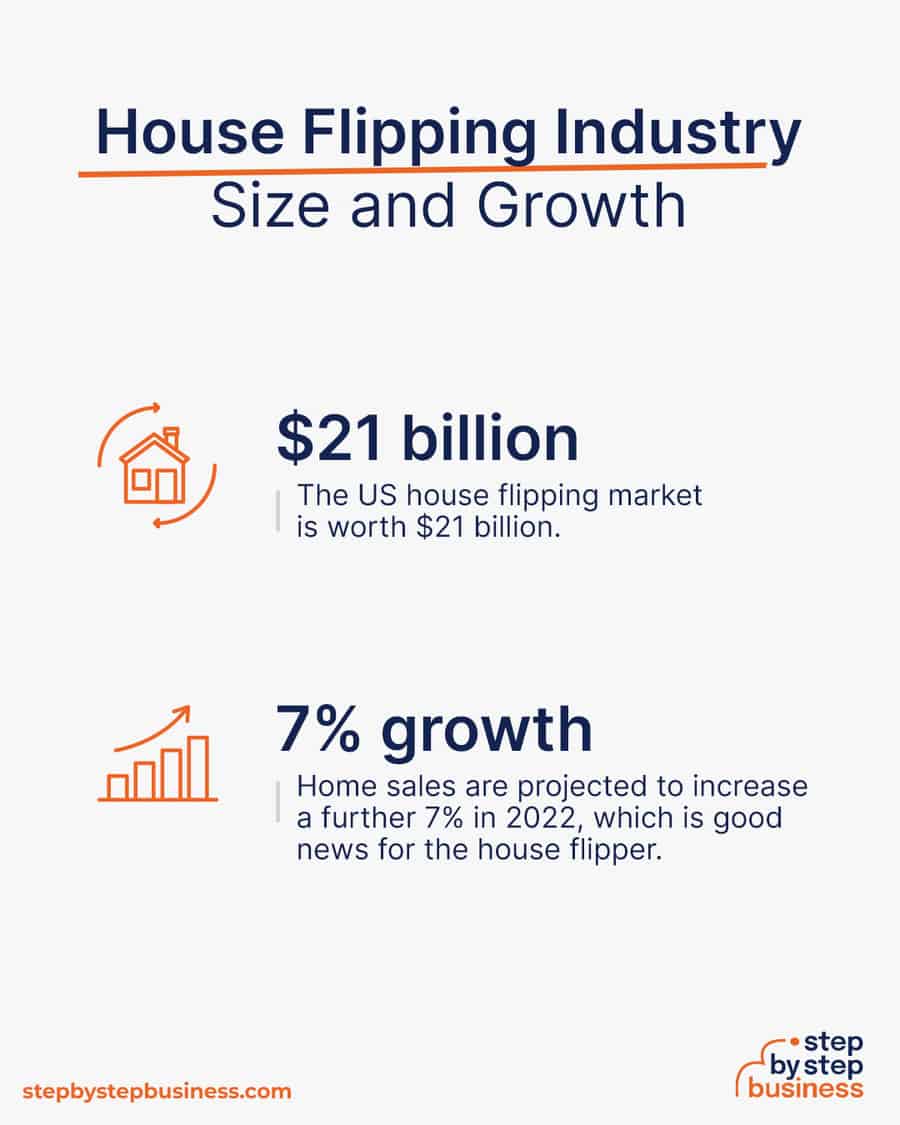

Industry size and growth

- Industry size and past growth – The US house flipping market is worth $21 billion. ATTOM says 323,465 homes and condos were flipped in 2021, 26% percent higher than the previous year. Each home flip earned $65,000 in gross profit.

- Growth forecast – Home sales are projected to increase a further 7% in 2022, which is good news for the house flipper.(( https://www.realtor.com/research/2022-national-housing-forecast/ ))

Trends and challenges

Trends in the house-flipping market include:

- The average gross profit on a flipped home was $65,000 in 2021. Gross profit is the difference between the sale price and the original purchase price and does not include the cost of renovations or carrying costs. The average net profit, meaning what you actually keep of the gross profit, is 40%.

- Over 40% of all home purchases by flippers were done with financing. Financing is often hard money financing, which is financing using the property as collateral and is usually done through a real estate investor or private money lender.

Challenges in the house-flipping industry include:

- Theft and damage are common problems for house flippers when the home is left vacant, adding to costs.

- Government regulations designed to discourage flipping can limit house-flipping opportunities. Homes that are backed by government agencies like FHA delay bidding for investors, giving the first opportunities to owner-occupant buyers.

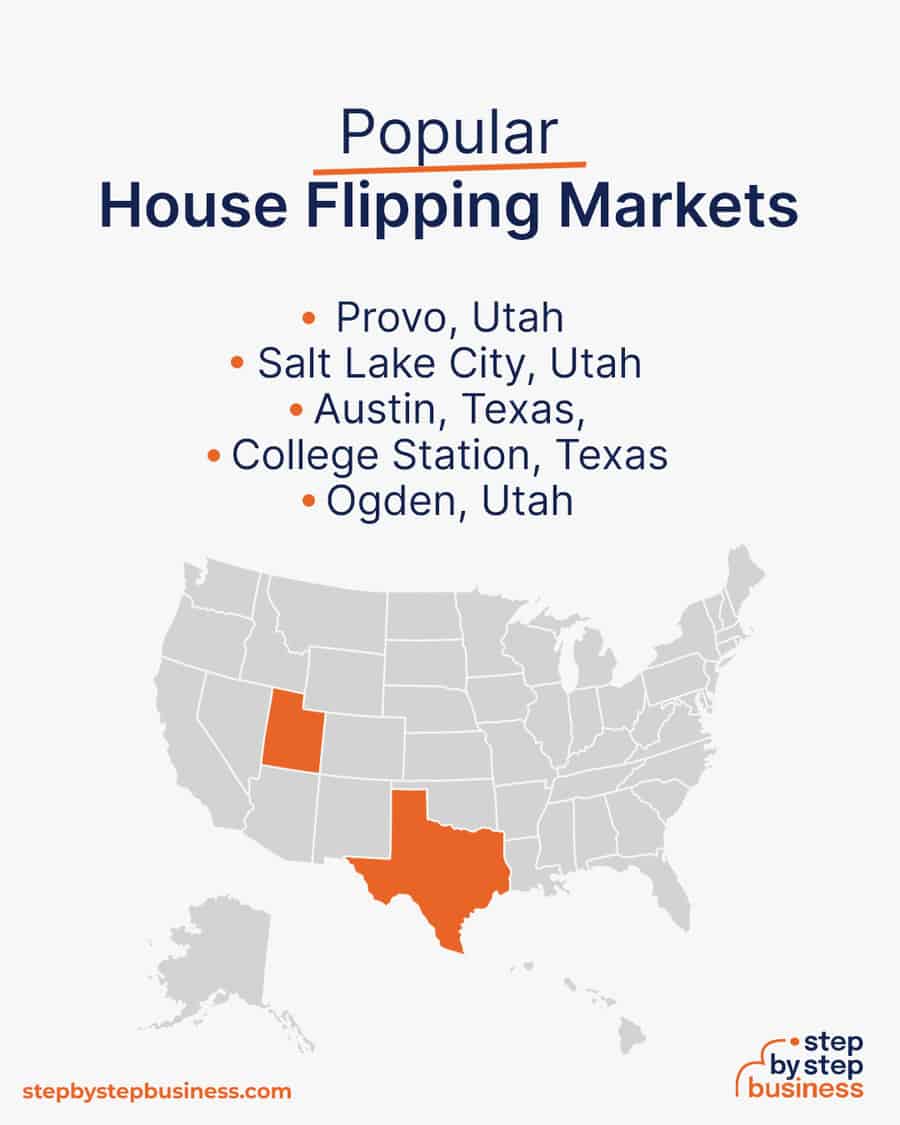

Popular house flipping markets

The largest annual increase in home flipping rates in 2021 were in:

- Provo, Utah

- Salt Lake City, Utah

- Austin, Texas,

- College Station, Texas

- Ogden, Utah

How much does it cost to start a house-flipping business?

Startup costs for a house-flipping business range from $30,000 to $60,000. The largest expenses are the 20% down payment on your first house and the cost of renovations. If you can do the renovations yourself, you’ll save some money. You might brush up on your carpentry skills or other remodeling schools with online classes at Penn Foster or Construct-ED .

Also, if you get your real estate license, as a real estate broker or a real estate agent, you can save money on commissions and keep even more cash in your pocket. Each state has its own laws, so you need to take state-specific real estate classes and pass your state’s real estate exam. You can usually get licensed in 3 – 6 months for about $1,500.

How much can you earn from a house-flipping business?

The average sale price of a flipped house is $267,000, which is $67,000 more, on average, than the initial sale price. After renovations and commissions, your profit margin should be about 40%, or nearly $27,000 per home.

In your first year or two flipping homes, you could flip one per quarter and bring in nearly $270,000 in annual revenue. This would mean almost $110,000 in profit, assuming that 40% margin. As your business gains traction, you could do 1 flip per month. With annual revenue of around $800,000, you’d make a tidy profit of more than $320,000.

What barriers to entry are there?

There are a few barriers to entry for a house-flipping business. Your biggest challenges will be:

- Funding your first down payment and renovations

- Finding quality properties at good prices

Step 2: Hone Your Idea

Now that you know what’s involved in starting a house-flipping business, it’s a good idea to hone your concept in preparation to enter a competitive market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

Why? Identify an opportunity

Research house-flipping businesses in your area to examine their renovations and sales prices. You’re looking for a market gap to fill. For instance, maybe local homebuyers would prefer a flipper that does high-quality renovations rather than cheap, fast-flip renovations.

You might consider targeting a niche market by specializing in a certain aspect of your industry, such as luxury homes or eco-friendly homes.

This could jumpstart your word-of-mouth marketing and attract clients right away.

What? Define your flipping strategy

Essentially, you need to determine two things:

- What price range homes you want to buy. Homes in higher price ranges will tend to bring in higher profit but will require more of an investment.

- The quality and extent of the renovations you want to do.

How much should you charge for house-flipping?

Your sales prices will depend on your local real estate market. Your expenses will be the purchase price, renovation costs, commissions, and carrying costs. You should try to aim for a profit margin of 40%.

Once you know your costs, you can use this Step By Step profit margin calculator to determine your mark-up and final price points.

Who? Identify your target market

Your target market will be two-fold:

- Home sellers willing to sell their homes at or below market value

- Home buyers interested in your renovated homes

Your best bet is to partner with realtors, who you can find on LinkedIn, Google Maps, or Yelp. You may also be able to call your local board of realtors to obtain a list. If you get your own real estate license, you’ll save as much as 7% of the sale price, which means thousands of dollars on every sale.

Where? Choose your business premises

In the early stages, you may want to run your business from home to keep costs low, and it’s likely that you will continue to do so. But as your business grows, you may need to hire workers for various roles and rent out an office. Find commercial space to rent in your area on sites such as Craigslist , Crexi , and Instant Offices .

When choosing a commercial space, you may want to follow these rules of thumb:

- Central location accessible via public transport

- Ventilated and spacious, with good natural light

- Flexible lease that can be extended as your business grows

- Ready-to-use space with no major renovations or repairs needed

Step 3: Brainstorm a House Flipping Business Name

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- Name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords, such as “renovated homes” or “upgraded homes”, boosts SEO

- Name should allow for expansion, for ex: “FlipNation LLC” over “Budget Flips LLC”

- A location-based name can help establish a strong connection with your local community and help with the SEO but might hinder future expansion

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool below. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Find a Domain

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that set your business apart. Once you pick your company name, and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Step 4: Create a House Flipping Business Plan

Here are the key components of a business plan:

- Executive Summary : A brief summary of the house flipping business plan, highlighting its key points and objectives.

- Business Overview : An introduction to the house flipping business, outlining its purpose and goals.

- Product and Services : Description of the specific properties you plan to buy and renovate, and the services provided in the process.

- Market Analysis : An examination of the real estate market, identifying opportunities and potential challenges for house flipping.

- Competitive Analysis : Assessment of competitors in the house flipping industry, highlighting their strengths and weaknesses.

- Sales and Marketing : Strategies for promoting and selling the renovated properties, including target markets and marketing tactics.

- Management Team : Profiles of key individuals involved in the business, detailing their roles and expertise.

- Operations Plan : Details on how the house flipping process will be executed, including renovation, project management, and property acquisition.

- Financial Plan : Projections of financial aspects, such as budgets, expenses, revenue forecasts, and return on investment.

- Appendix : Supplementary information, such as supporting documents, legal agreements, and additional data to support the business plan.

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

Step 5: Register Your Business

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Choose where to register your company

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you’re planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to house-flipping businesses.

If you’re willing to move, you could really maximize your business! Keep in mind, it’s relatively easy to transfer your business to another state.

Choose your business structure

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your house-flipping business will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Here are the main options:

- Sole Proprietorship – The most common structure for small businesses makes no legal distinction between company and owner. All income goes to the owner, who’s also liable for any debts, losses, or liabilities incurred by the business. The owner pays taxes on business income on his or her personal tax return.

- General Partnership – Similar to a sole proprietorship, but for two or more people. Again, owners keep the profits and are liable for losses. The partners pay taxes on their share of business income on their personal tax returns.

- Limited Liability Company (LLC) – Combines the characteristics of corporations with those of sole proprietorships or partnerships. Again, the owners are not personally liable for debts.

- C Corp – Under this structure, the business is a distinct legal entity and the owner or owners are not personally liable for its debts. Owners take profits through shareholder dividends, rather than directly. The corporation pays taxes, and owners pay taxes on their dividends, which is sometimes referred to as double taxation.

- S Corp – An S-Corporation refers to the tax classification of the business but is not a business entity. An S-Corp can be either a corporation or an LLC, which just needs to elect to be an S-Corp for tax status. In an S-Corp, income is passed through directly to shareholders, who pay taxes on their share of business income on their personal tax returns.

We recommend that new business owners choose LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using an online LLC formation service. They will check that your business name is available before filing, submit your articles of organization, and answer any questions you might have.

Form Your LLC

Choose Your State

We recommend ZenBusiness as the Best LLC Service for 2024

Step 6: Register for Taxes

The final step before you’re able to pay taxes is getting an Employer Identification Number, or EIN. You can file for your EIN online or by mail or fax: visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist , and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you’re completing them correctly.

Step 7: Fund your Business

Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans: This is the most common method but getting approved requires a rock-solid business plan and strong credit history.

- SBA-guaranteed loans: The Small Business Administration can act as guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan .

- Government grants: A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Friends and Family: Reach out to friends and family to provide a business loan or investment in your concept. It’s a good idea to have legal advice when doing so because SEC regulations apply.

- Crowdfunding: Websites like Kickstarter and Indiegogo offer an increasingly popular low-risk option, in which donors fund your vision. Entrepreneurial crowdfunding sites like Fundable and WeFunder enable multiple investors to fund your business.

- Personal: Self-fund your business via your savings or the sale of property or other assets.

Bank loans are probably the best options, other than friends and family, for funding a house-flipping business. You can also look for hard money lenders online.

Step 8: Apply for Licenses/Permits

Starting a house-flipping business requires obtaining a number of licenses and permits from local, state, and federal governments. Getting a real estate license is not necessary, but it will increase your profits.

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration ( OSHA ), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package . They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Step 9: Open a Business Bank Account

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account.

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you’re running your house-flipping business as a sole proprietorship. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.