- For educators

Fundamental Financial Accounting Concepts with Connect Plus (8th Edition) Edit edition This problem has been solved: Solutions for Chapter 3 …

Calculate the company’s debt to assets ratio for year 2010 and 2009:

Debt to total assets ratio:

Debt to total assets ratio indicates the financial leverage of the company. It shows the percentage of the assets financed by the debt (liabilities and creditors). Higher debt ratio indicates that greater leverage and more finance risk.

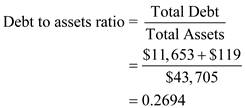

The debt to assets ratio is calculated by dividing total debt by total assets.

The debt to assets ratio for the company in 2010 is the following:

Therefore, the debt to assets ratio for the company in 2010 is 0.2694.

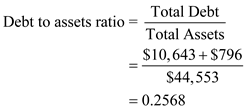

The debt to assets ratio for the company in 2009 is the following:

Therefore, the debt to assets ratio for the company in 2009 is 0.2568.

Calculate the company’s return on assets ratio for year 2010 and 2009:

It is also called as return on assets. It measures company’s success in using assets to earn income. Interest expense and net income are the returns to creditors and stockholders respectively. Return on assets will be calculated by using following formula:

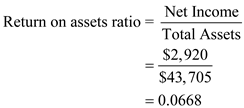

The return on assets ratio is calculated by dividing net income by total assets.

The return on assets ratio for the company in 2010 is the following:

Therefore, the return on assets ratio for the company in 2010 is 0.0668.

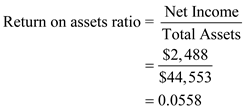

The return on assets ratio for the company in 2009 is the following:

Therefore, the return on assets ratio for the company in 2009 is 0.0558.

Calculate the company’s return on equity ratio for year 2010 and 2009:

Return on equity shows the percentage of net income on their stockholders equity. It indicts that profitability of company’s stockholders. Following is the formula for return on equity:

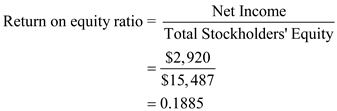

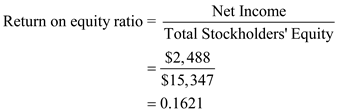

The return on equity ratio is calculated by dividing net income by stockholders’ equity.

The return on equity ratio for the company in 2010 is the following:

Therefore, the return on equity ratio for the company in 2010 is 0.1885.

The return on equity ratio for the company in 2009 is the following:

Therefore, the return on equity ratio for the company in 2009 is 0.1621.

The company’s return on equity was higher than its return on assets ratio for 2010 and 2009 because the company’s stockholders’ equity was lower than its total assets amount.

Corresponding textbook

- About Chegg

- Chegg For Good

- College Marketing

- Corporate Development

- Investor Relations

- Join Our Affiliate Program

- Media Center

LEGAL & POLICIES

- Advertising Choices

- Cookie Notice

- General Policies

- Intellectual Property Rights

- Terms of Use

- Global Privacy Policy

- DO NOT SELL MY INFO

- Honor Shield

CHEGG PRODUCTS AND SERVICES

- Cheap Textbooks

- Chegg Coupon

- Chegg Study Help

- College Textbooks

- Chegg Math Solver

- Mobile Apps

- Solutions Manual

- Textbook Rental

- Used Textbooks

- Digital Access Codes

- Chegg Money

CHEGG NETWORK

- Internships.com

CUSTOMER SERVICE

- Customer Service

- Give Us Feedback

- Manage Subscription

© 2003- 2024 Chegg Inc. All rights reserved.