Cash Flow and Other Financial Statements Essay

Financial statements are crucial for any enterprise as they reflect the actual state of a company’s budget. They are used by both business owners and investors to evaluate the actual efficiency of operations. According to Kennon (2018), the primary objective is to understand and calculate ratios, which allow determining the profitability of an enterprise. One of the approaches for creating and examining such statements is the balance sheet.

Cash flow is a subtype of a financial statement, which reflects the balance of a company’s financials. Akdeniz (2015) states that cash flow consists of “operating, investing, and financing activities” (p. 10). In a way, this report is similar to the income statement as both provide insight into performance measures and profitability.

The specific aspect, which distinguished cash flow from other financial statements, is that it does not reflect noncash operations. For instance, depreciation would not be included in such report. Additionally, it is especially crucial for small businesses to calculate their cash flow on a quarterly basis (“Cash flow statement,” n.d.). It is because adequate management of cash is necessary for an establishment to be able to pay the bills as required.

This type of financial statements is helpful in identifying a company’s ability to pay for its activities on a daily basis. It should be applied to determine the economic component in the short-term perspective. Inflows, outflows, and their management are the primary objectives for cash flow calculations (“Cash flow statement,” n.d.). It should be noted that a company, that is considered profitable by accounting standards would present adverse results in its cash flow calculations. Thus, it is essential to understand the value of a cash flow statement and ensure that a company calculates the ratios on a regular basis.

Akdeniz, C. (2015). Financial statements explained . Bad Bodendorf, Germany: First Publishing.

Cash flow statement . (n.d.). Web.

Kennon, J. (2018). How to read and understand financial statements . The Balance . Web.

- Apple Inc. Financial Performance

- Cash Flow Statements for Financial Management

- Influenza: Six Stages and Three Periods From the Time a Virus Is Shown Signs

- Depreciation: Tax Impact, Methods, and Best Practices

- Stoichiometry and Process Calculations

- Nestle Pakistan Ltd: Financial Information

- Financial Analysis and Forecasting Using Twitter

- Lemonade Stand Business: Accounting Perspective

- Gunther International Company's New Financing

- National Guard Armory's Investment Options

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2021, May 22). Cash Flow and Other Financial Statements. https://ivypanda.com/essays/cash-flow-and-other-financial-statements/

"Cash Flow and Other Financial Statements." IvyPanda , 22 May 2021, ivypanda.com/essays/cash-flow-and-other-financial-statements/.

IvyPanda . (2021) 'Cash Flow and Other Financial Statements'. 22 May.

IvyPanda . 2021. "Cash Flow and Other Financial Statements." May 22, 2021. https://ivypanda.com/essays/cash-flow-and-other-financial-statements/.

1. IvyPanda . "Cash Flow and Other Financial Statements." May 22, 2021. https://ivypanda.com/essays/cash-flow-and-other-financial-statements/.

Bibliography

IvyPanda . "Cash Flow and Other Financial Statements." May 22, 2021. https://ivypanda.com/essays/cash-flow-and-other-financial-statements/.

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

- Call to +1 844 889-9952

Cash Flow: Definition and Concepts

Definition and concepts.

A cash flow statement represents significant financial declarations for a business or project. It provides information about cash receipts and payments of a venture for a given time frame (Profit, p. 33). The document is crucial for determining a firm’s stability in the business. Cash flow statements help in tracing the various sources of cash such as operations, sales of current and fixed assets, issuance of share capital, and borrowed income. Further, it shows cash outflows, including the purchase of existing and fixed assets, the redemption of debentures, and preference shares, among other expenses (Klammer, p. 200). According to Profit, a cash flow statement contains essential information that provides a basis for evaluating a company’s ability to generate cash and cash equivalents as well as the needs of the venture to utilize such cash flows (p. 34).

The preparation of cash flow statements aims at fulfilling several objectives. For instance, it helps to determine a project’s rate of return. As well, traders use cash flow statements to identify problems with an enterprise’s liquidity. Khan et al. postulate that a business can fail in the event of cash shortages despite being profitable (p. 953). In addition, cash flow statements guide businesses in determining profits as well as evaluating default perils and re-investment needs. Arnold et al. maintain that cash flow should be distinguished from profitability (p. 46).

Fundamental Methodologies and Examples

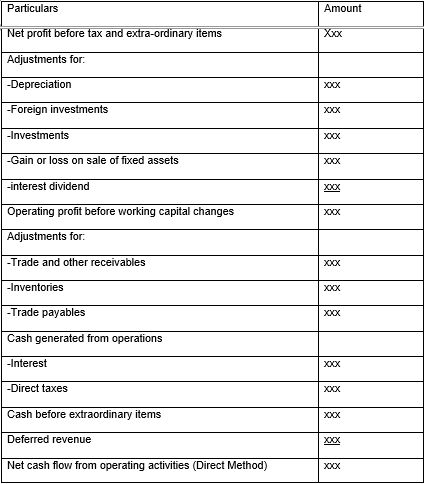

There are three methodologies of preparing cash flow statements, namely, operation, investment, and financing activities. Klammer notes that the operations option entails two approaches, which include the direct and indirect methods (p. 232). Operating activities represent the primary revenue-generating endeavors of an enterprise as well as other businesses that do not involve investments or funding. Operating activities encompass transactions that involve revenue receipts and expenses that affect net income (Khan et al, p. 954). The direct method presents a cash flow statement as an income statement or a profit and loss account determined on a cash basis. In this technique, the difference between cash receipts and cash payments provides the net cash flow. It is noteworthy that the direct method omits non-cash transactions. Items of cash in-flow include receipts from the sale of products, royalties, fees, and commissions, among other revenue(Arnold et al, p. 47). The cash out-flow encompass payments to suppliers of goods or services and employees. Klammernotes that it is necessary to make adjustments for an increase/decrease in both current assets and liabilities to get net cash flows from the operations (see table 1).

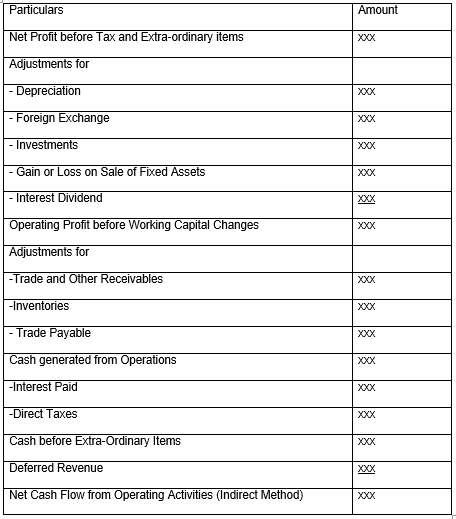

The alternative method uses the net profit/loss for the given time frame as the base (see table 2). However, it is essential to make adjustments for items that influenced the income statement but did not impact the cash. Moreover, the indirect method requires the addition of non-cash and non-operating charges in the revenue declaration to the net earnings (Klammer 245). As well, it mandates subtraction of non-cash and non-operating credits to determine the operating profit before working capital changes. Again, it is mandatory to make adjustments in both current assets and liabilities to establish the remaining cash flow from the firm’s operations (Arnold et al, p. 46).

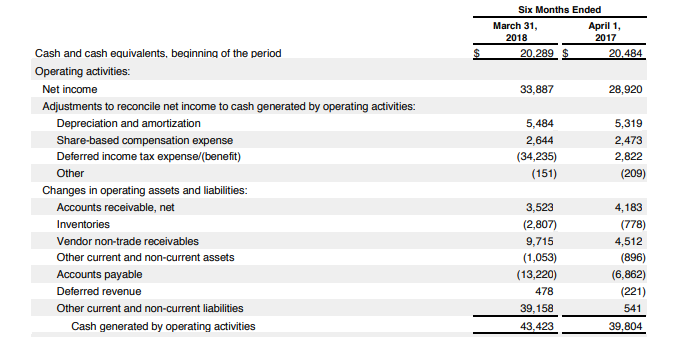

Analysts compare statements from operating activities with an enterprise’s net income to assess the quality of its paychecks. For example, when cash flow is higher than net income, economists give the company’s earnings a higher rating(Profir, p. 38). Contrastingly, low cash flow from operations signals an alarm to investors. An example of a cash flow statement from operations for Apple Inc. between April 1st, 2017, and March 31st, 2018 is shown in table 3.

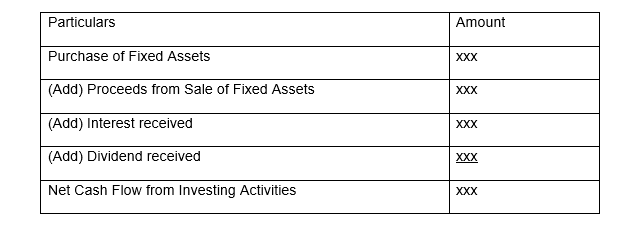

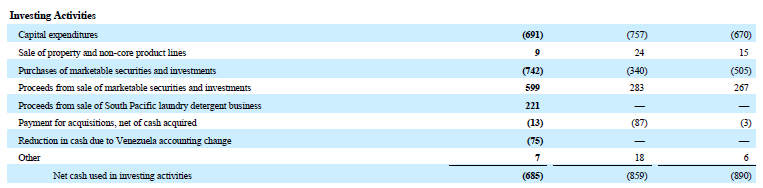

Further, a firm can analyze cash flows using investment activities, which involve acquisitions and sales of long-term assets. Investing activities comprise firms’ transactions and events that entail the purchase of long-term productive assets that are not meant for resales such as land, equipment, and machinery. Items from cash inflows from investing activities include cash receipts from the sale of fixed assets, including intangibles, shares, and warrants (Klammer 270). Further, repayments of overdrafts and loans given to third parties form part of cash inflows for investing activities. In addition, cash earnings and expenditures that associate with future, option, swap, and forward contracts fall in the category of investing activities. According to Arnold et al., items of cash outflows from investing activities include payments made in the acquisition of fixed assets and expenses on capitalized research and development expenditures (48). Likewise, cash outflows comprise payments made to obtain shares, permits, debt instruments of other companies, interests in joint ventures, cash upfronts, and lendsmade to third parties (see table 4).

Table 5 shows an example of a cash flow statement from investment activities for Colgate in 2015. The company’s cash flow from investments amounted to $685 million in 2015 and $859 million the previous year. Moreover, the table estimates that Colgate’s principal capital reached $691 million in 2015 while it amounted to $757 million in 2014. The company obtained $599 million as earnings from the disposal of vendible securities and reserves (Klammer, p. 270).

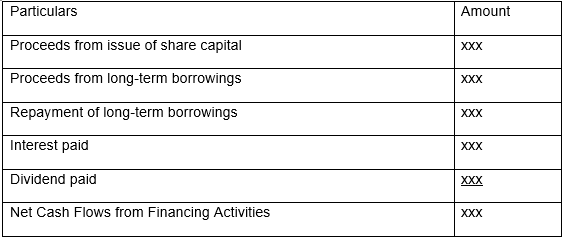

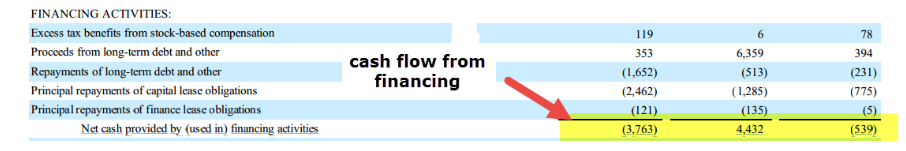

Additionally, cash flows can be analyzed from the funding activities of an enterprise. Such activities cause changes in the scope and structure of a firm’s capital and debt (Klammer 280). Items of cash inflows from financing activities comprise proceeds from issued shares, bonds, debentures, loan notes, and other temporary borrowings. Particulars of cash outflows for this method include cash repayments of borrowed funds and dividends (Arnold et al, p. 52). Preparation of cash flow statement from financing activities is shown below in Table 6. Furthermore, an example of cash flow analysis from financing activities for Amazon is shown in table 7.

For instance, cash flows for Amazon in 2014 involved repayments of long-term debt, capital, and finance lease obligations (see table 7). The proceeds from long-term financing remained consistently high. The information indicates that Amazon borrowed long-term debt continually. Likewise, repayments for long-term funding display massive cash outflow, which shows that the company paid long-term debt extensively in 2014. This information is crucial for investors to explore whether Amazonfinanced its debt by taking additional loans.

Works Cited

- Arnold, Allen G., et al. “Toward Effective Use of the Statement of Cash Flows.” Journal of Business & Behavioral Sciences , vol. 30, no. 2,2018, p. 46-54.

- Khan, Usman A, et al. “A Critical Analysis of the Internal and External Environment of Apple Inc.” International Journal of Economics, Commerce, and Management , vol. 3, no.6, 2015, pp. 955-961.

- Klammer, Tom. Statement of Cash Flows . 6th ed., John Wiley & Sons, 2018.

- Profir Ludmila. “Analysis of Financial Performance Based on the Relationship between Investments and Cash-Flow.” Management Intercultural , vol. 1, no. 40, 2018, pp. 33-48.

Cite this paper

Select style

- Chicago (A-D)

- Chicago (N-B)

BusinessEssay. (2022, October 15). Cash Flow: Definition and Concepts. https://business-essay.com/cash-flow-definition-and-concepts/

"Cash Flow: Definition and Concepts." BusinessEssay , 15 Oct. 2022, business-essay.com/cash-flow-definition-and-concepts/.

BusinessEssay . (2022) 'Cash Flow: Definition and Concepts'. 15 October.

BusinessEssay . 2022. "Cash Flow: Definition and Concepts." October 15, 2022. https://business-essay.com/cash-flow-definition-and-concepts/.

1. BusinessEssay . "Cash Flow: Definition and Concepts." October 15, 2022. https://business-essay.com/cash-flow-definition-and-concepts/.

Bibliography

BusinessEssay . "Cash Flow: Definition and Concepts." October 15, 2022. https://business-essay.com/cash-flow-definition-and-concepts/.

- TANF and Medicaid: Review

- Stephen Leacock’s “Wizard of Finance” Review

- Analysis of Airport Governmental Funding

- Chinese Banking System: Profitability, Assets, Equity and Performance Ratios

- Diversifying Funding Sources for Financial Sustainability: Clayton County, Georgia

- Term Structure Models in the Banking Sector

- Voluntary Disclosure: Comparative Qualitative Document Analysis

- Saudi Arabia’s Economy Analysis

- Different Aspects of Financial Stability

- Organizational Change Management: Fall Out From Global Financial Crisis

- Demand for Property Microinsurance in Canada

- The Role of Banks in the 2008 International Financial Crisis

- How to Build an Emergency Fund

- The Causes of Exchange Rate Fluctuations

- Trouble Asset Relief Program: Money Trail

Essay on Cash Flow

Students are often asked to write an essay on Cash Flow in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Cash Flow

What is cash flow.

Cash flow is the money that moves in and out of a business. Think of it like water flowing through a pipe. Money comes in when customers buy things, and money goes out when the business pays for stuff like supplies or salaries.

Types of Cash Flow

There are two main kinds: positive and negative. Positive means more money is coming in than going out. This is good. Negative is the opposite, where more money goes out than comes in. This can be bad for the business.

Why Cash Flow Matters

Cash flow is important because it helps businesses stay open. Without enough money coming in, a business might not be able to pay for what it needs or might even have to close down. Keeping track of cash flow helps businesses make smart choices.

250 Words Essay on Cash Flow

Understanding cash flow.

Cash flow is the money that comes in and out of a business or a person’s pocket. Think of it like water in a river. Money flows in from things like sales of products or getting an allowance, and it flows out when bills are paid or when you buy something.

There are two main types of cash flow: positive and negative. Positive cash flow means more money is coming in than going out. This is good because it means there’s extra money available. Negative cash flow is the opposite; it’s like having a hole in your pocket where more money is leaving than coming in.

Cash flow is important because it keeps the business running. Without enough money coming in, a business can’t pay its bills, buy new things it needs, or pay its workers. For individuals, good cash flow means being able to afford things like food, clothes, and fun activities.

Improving Cash Flow

To improve cash flow, a business can try to make more sales or cut down on costs. People can do similar things by finding ways to earn more money, like doing extra chores, or spending less on things they don’t need.

In summary, cash flow is the movement of money in and out. It’s crucial for businesses and individuals to keep track of cash flow to make sure they don’t run out of money. By managing cash flow well, they can stay financially healthy and plan for the future.

500 Words Essay on Cash Flow

Cash flow is like the blood that flows in our bodies, but for a business, it’s the money that comes in and goes out. Imagine you have a piggy bank. When you put money into it, that’s money coming in. When you take money out to buy something, that’s money going out. For a business, keeping track of this is very important because it helps them understand if they have enough money to pay for things they need, like supplies, employees, and rent.

There are mainly two types of cash flow: positive and negative. Positive cash flow happens when a company gets more money than it spends. This is good because it means the business can pay its bills, invest in new things, and save some money too. Negative cash flow is when a business spends more money than it makes. This isn’t good because it might mean the business has to borrow money or find other ways to make up for the shortage.

Why Cash Flow is Important

Think of a game where you need to keep score to know who’s winning. For a business, cash flow is like keeping score. It shows if the business is doing well or if it’s in trouble. It’s important because it tells the business owners if they have enough money to keep the business running. Without enough cash, a business might not be able to buy what it needs or pay its workers, which can lead to big problems.

How to Manage Cash Flow

Managing cash flow means making sure that the money coming in is always enough to cover the money going out. Businesses do this by making a plan or a budget. They try to predict how much money they will make and spend in the future. This helps them make smart choices, like not spending too much or finding ways to bring in more money when needed.

Tools to Help with Cash Flow

There are tools that help businesses keep track of their cash flow. These can be simple like a notebook where they write down all the money they get and spend, or more complex like computer programs that do the math for them. These tools help businesses stay organized and make sure they don’t run out of money.

In conclusion, cash flow is all about the money that moves in and out of a business. It’s crucial for businesses to keep an eye on it because it shows how healthy the business is. By managing cash flow well, businesses can make sure they have enough money to operate and grow. It’s a bit like making sure you have enough allowance to buy what you need and save up for something special in the future.

That’s it! I hope the essay helped you.

If you’re looking for more, here are essays on other interesting topics:

- Essay on Career

- Essay on Care Of Pets

- Essay on Carbon Footprint

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Accounting Services

Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support. Less stress for you, more time to grow your business.

Ongoing online bookkeeping service for small business owners

Catch up bookkeeping services for small businesses, no matter how far behind they are

All-in-one small business tax preparation, filing and year-round income tax advisory

Expert support for small businesses to resolve IRS issues and reduce back tax liabilities

Book a demo with our friendly team of experts

Not sure where to start or which accounting service fits your needs? We’re just a call away. Our team is ready to learn about your business and guide you to the right solution.

Easy-To-Use Platform

Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions.

Effortless messaging with your Bench team for unlimited support or advice, anytime, anywhere

Upload, manage and access your financial documents swiftly with just a few clicks

Connect all your financial accounts to automate data entry, speed up your books, reduce errors and save time

Accurate transaction categorization, powered by smart automation with instant guidance

Real-time reporting. Access or download your updated income statement or balance sheet at all times

Get timely reminders to stay on top of your financial tasks and deadlines

See Bench’s features in action

The magic happens when our intuitive software and real, human support come together. Book a demo today to see what running your business is like with Bench.

Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. Empower yourself with knowledge and practical tips.

Tips for understanding business finances Accounting · Bookkeeping Operations · Tax Tips

Live and on-demand recordings of webinars covering everything from bookkeeping to taxes

Free downloadable bookkeeping and tax guides, checklists, and expert-tested accounting templates

Tools and calculators to help you stay on top of your small business taxes and evaluate your financials

Info about small business tax deadlines, deductions, IRS forms and tax filing support - all in one, easy-to-access place

See what’s new at Bench and learn more about our company

Free Course: Understanding Financial Statements

Learn how to build, read, and use financial statements for your business so you can make more informed decisions. Easy-to-use templates and financial ratios provided.

Learn more about Bench, our mission, and the dedicated team behind your financial success. We’re committed to helping you thrive.

Learn about what we do, how we got here and why our hearts are in it

Learn how we’re committed to building a more just and inclusive society through our work

Hear straight from our customers why thousands of small business owners trust Bench with their finances

Answers to the common questions we get about our services and our software

The latest news, updates, and happenings from Bench

We partner with businesses that help other small businesses scale—see who’s on the list

“Working with Bench has saved me so many times. I could have made decisions for my business that would not have turned out well, should they have not been made based on the numbers.”

Cash Flow Statement: Explanation and Example

Bryce Warnes

Reviewed by

Janet Berry-Johnson, CPA

February 28, 2024

This article is Tax Professional approved

A cash flow statement tells you how much cash is entering and leaving your business in a given period. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

I am the text that will be copied.

Cash flow statements are also required by certain financial reporting standards.

What makes a cash flow statement different from your balance sheet is that a balance sheet shows the assets and liabilities your business owns (assets) and owes (liabilities). The cash flow statement simply shows the inflows and outflows of cash from your business over a specific period of time, usually a month.

Let's take a closer look at what cash flow statements do for your business, and why they're so important. Then, we'll walk through an example cash flow statement, and show you how to create your own using a template.

What is the purpose of a cash flow statement?

A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period.

While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time.

Cash flow statement vs. balance sheet

A balance sheet shows you your business’s assets, liabilities, and owner’s equity at a specific moment in time—typically at the end of a quarter or a year.

What it doesn’t show is revenue or expenses, or any of the business’s other cash activities that impact your company’s day-to-day health. Those activities are recorded on your cash flow statement.

Cash flow statement vs. income statement

Using only an income statement to track your cash flow can lead to serious problems—and here’s why.

If you use accrual basis accounting, income and expenses are recorded when they are earned or incurred—not when the money actually leaves or enters your bank accounts. (The cash accounting method only records money once you have it on hand. Learn more about the cash vs. accrual basis systems of accounting.)

So, even if you see income reported on your income statement, you may not have the cash from that income on hand. The cash flow statement makes adjustments to the information recorded on your income statement, so you see your net cash flow—the precise amount of cash you have on hand for that time period.

For example, depreciation is recorded as a monthly expense. However, you've already paid cash for the asset you're depreciating; you record it on a monthly basis in order to see how much it costs you to have the asset each month over the course of its useful life. But cash isn't literally leaving your bank account every month.

The cash flow statement takes that monthly expense and reverses it—so you see how much cash you have on hand in reality, not how much you've spent in theory.

Why do you need cash flow statements?

So long as you use accrual accounting, cash flow statements are an essential part of financial analysis for three reasons:

- They show your liquidity . That means you know exactly how much operating cash flow you have in case you need to use it. So you know what you can afford, and what you can’t.

- They show you changes in assets, liabilities, and equity in the forms of cash outflows, cash inflows, and cash being held. Those three categories are the core of your business accounting. Together, they form the accounting equation that lets you measure your performance.

- They let you predict future cash flows . You can use cash flow statements to create cash flow projections , so you can plan for how much liquidity your business will have in the future. That’s important for making long-term business plans.

On top of that, if you plan on securing a loan or line of credit, you’ll need up-to-date cash flow statements to apply.

Negative cash flow vs. positive cash flow

When your cash flow statement shows a negative number at the bottom, that means you lost cash during the accounting period—you have negative cash flow. It’s important to remember that long-term, negative cash flow isn’t always a bad thing. For example, early stage businesses need to track their burn rate as they try to become profitable.

When you have a positive number at the bottom of your statement, you’ve got positive cash flow for the month. Keep in mind, positive cash flow isn’t always a good thing in the long term. While it gives you more liquidity now, there are negative reasons you may have that money—for instance, by taking on a large loan to bail out your failing business. Positive cash flow isn’t always positive overall.

Where do cash flow statements come from?

If you do your own bookkeeping in Excel , you can calculate cash flow statements each month based on the information on your income statements and balance sheets. If you use accounting software , it can create cash flow statements based on the information you’ve already entered in the general ledger .

Keep in mind, with both those methods, your cash flow statement is only accurate so long as the rest of your bookkeeping is accurate too. The most surefire way to know how much working capital you have is to hire a bookkeeper . They’ll make sure everything adds up, so your cash flow statement always gives you an accurate picture of your company’s financial health.

Statements of cash flow using the direct and indirect methods

In order to figure out your company’s cash flow, you can take one of two routes: The direct method, and the indirect method. While generally accepted accounting principles (US GAAP) approve both, the indirect method is typically preferred by small businesses.

The direct method of calculating cash flow

Using the direct method, you keep a record of cash as it enters and leaves your business, then use that information at the end of the month to prepare a statement of cash flow.

The direct method takes more legwork and organization than the indirect method—you need to produce and track cash receipts for every cash transaction. For that reason, smaller businesses typically prefer the indirect method.

Also worth mentioning: Even if you record cash flows in real time with the direct method, you’ll also need to use the indirect method to reconcile your statement of cash flows with your income statement. So, you can usually expect the direct method to take longer than the indirect method.

The indirect method of calculating cash flow

With the indirect method, you look at the transactions recorded on your income statement, then reverse some of them in order to see your working capital. You’re selectively backtracking your income statement in order to eliminate transactions that don’t show the movement of cash.

Since it’s simpler than the direct method, many small businesses prefer this approach. Also, when using the indirect method, you do not have to go back and reconcile your statements with the direct method.

In our examples below, we’ll use the indirect method of calculating cash flow.

How the cash flow statement works with the income statement and the balance sheet

You use information from your income statement and your balance sheet to create your cash flow statement. The income statement lets you know how money entered and left your business, while the balance sheet shows how those transactions affect different accounts—like accounts receivable , inventory, and accounts payable .

So, the process of producing financial statements for your business goes:

Income Statement + Balance Sheet = Cash Flow Statement

Example of a cash flow statement

Now that we’ve got a sense of what a statement of cash flows does and, broadly, how it’s created, let’s check out an example.

There’s a fair amount to unpack here. But here’s what you need to know to get a rough idea of what this cash flow statement is doing.

- Red dollar amounts decrease cash. For instance, when we see ($30,000) next to “Increase in inventory,” it means inventory increased by $30,000 on the balance sheet. We bought $30,000 worth of inventory, so our cash balance decreased by that amount.

- Black dollar amounts increase cash. For example, when we see $20,000 next to “Depreciation,” that $20,000 is an expense on the income statement, but depreciation doesn’t actually decrease cash. So we add it back to net income.

You’ll also notice that the statement of cash flows is broken down into three sections—Cash Flow from Operating Activities, Cash Flow from Investing Activities, and Cash Flow from Financing Activities. Let’s look at what each section of the cash flow statement does.

The three sections of a cash flow statement

These three activities sections of the statement of cash flows designate the different ways cash can enter and leave your business.

- Cash Flow from Operating Activities is cash earned or spent in the course of regular business activity—the main way your business makes money, by selling products or services.

- Cash Flow from Investing Activities is cash earned or spent from investments your company makes, such as purchasing equipment or investing in other companies.

- Cash Flow from Financing Activities is cash earned or spent in the course of financing your company with loans, lines of credit, or owner’s equity .

Using the cash flow statement example above, here’s a more detailed look at what each section does, and what it means for your business.

Cash Flow from Operating Activities

For most small businesses, Operating Activities will include most of your cash flow. That’s because operating activities are what you do to get revenue. If you run a pizza shop, it’s the cash you spend on ingredients and labor, and the cash you earn from selling pies. If you’re a registered massage therapist , Operating Activities is where you see your earned cash from giving massages, and the cash you spend on rent and utilities.

Cash Flow from Operating Activities in our example

Taking another look at this section, let’s break it down line by line.

Net income is the total income, after expenses, for the month. We get this from the income statement.

Depreciation is recorded as a $20,000 expense on the income statement. Here, it’s listed as income. Since no cash actually left our hands, we’re adding that $20,000 back to cash on hand.

Increase in Accounts Payable is recorded as a $10,000 expense on the income statement. That’s money we owe—in this case, let’s say it’s paying contractors to build a new goat pen. Since we owe the money, but haven’t actually paid it, we add that amount back to the cash on hand.

Increase in Accounts Receivable is recorded as a $20,000 growth in accounts receivable on the income statement. That’s money we’ve charged clients—but we haven’t actually been paid yet. Even though the money we’ve charged is an asset, it isn’t cold hard cash. So we deduct that $20,000 from cash on hand.

Increase in Inventory is recorded as a $30,000 growth in inventory on the balance sheet. That means we’ve paid $30,000 cash to get $30,000 worth of inventory. Inventory is an asset, but it isn’t cash—we can’t spend it. So we deduct the $30,000 from cash on hand.

Net Cash from Operating Activities , after we’ve made all the changes above, comes out to $40,000.

Meaning, even though our business earned $60,000 in October (as reported on our income statement), we only actually received $40,000 in cash from operating activities.

Cash Flow from Investing Activities

This section covers investments your company has made—by purchasing equipment, real estate, land, or easily liquidated financial products referred to as “cash equivalents.” When you spend cash on an investment, that cash gets converted to an asset of equal value.

If you buy a $10,000 mower for your landscaping company, you lose $10,000 cash and get a $10,000 mower. If you buy a $140,000 retail space, you lose $140,000 cash and get a $140,000 retail space.

Under Cash Flow from Investing Activities, we reverse those investments, removing the cash on hand. They have cash value, but they aren’t the same as cash—and the only asset we’re interested in, in this context, is currency.

For small businesses, Cash Flow from Investing Activities usually won’t make up the majority of cash flow for your company. But it still needs to be reconciled, since it affects your working capital.

Cash Flow from Investing Activities in our example

Purchase of Equipment is recorded as a new $5,000 asset on our income statement. It’s an asset, not cash—so, with ($5,000) on the cash flow statement, we deduct $5,000 from cash on hand.

Cash Flow from Financing Activities

This section covers revenue earned or assets spent on Financing Activities. When you pay off part of your loan or line of credit, money leaves your bank accounts. When you tap your line of credit, get a loan, or bring on a new investor, you receive cash in your accounts.

Cash Flow from Financing Activities in our example

Notes payable is recorded as a $7,500 liability on the balance sheet. Since we received proceeds from the loan, we record it as a $7,500 increase to cash on hand.

Cash flow for the month

At the bottom of our cash flow statement, we see our total cash flow for the month: $42,500.

Even though our net income listed at the top of the cash flow statement (and taken from our income statement) was $60,000, we only received $42,500.

That’s $42,500 we can spend right now, if need be. If we only looked at our net income, we might believe we had $60,000 cash on hand. In that case, we wouldn’t truly know what we had to work with—and we’d run the risk of overspending, budgeting incorrectly, or misrepresenting our liquidity to loan officers or business partners.

Using a cash flow statement template

Do your own bookkeeping using spreadsheets? In that case, using a cash flow statement template will save you time and energy.

Our Free Cash Flow Statement Template is easy to download and simple to use.

How to track cash flow using the indirect method

Four simple rules to remember as you create your cash flow statement:

- Transactions that show an increase in assets result in a decrease in cash flow.

- Transactions that show a decrease in assets result in an increase in cash flow.

- Transactions that show an increase in liabilities result in an increase in cash flow.

- Transactions that show a decrease in liabilities result in a decrease in cash flow.

If you’ve already gone through the example statement above and you feel like you have a pretty good grasp of how to create a cash flow statement, go ahead and start experimenting with our free templates :

- Income Statement Template

- Balance Sheet Template

- Cash Flow Template

But if you’d like to get a clearer idea of how it all works, this quick example should help.

Creating a cash flow statement from your income statement and balance sheet

Let’s say we’re creating a cash flow statement for Greg’s Popsicle Stand for July 2019.

Our income statement looks like this:

Note: For the sake of simplicity, this example omits income tax.

And our balance sheet looks like this:

Remember the four rules for converting information from an income statement to a cash flow statement? Let’s use them to create our cash flow statement.

Our net income for the month on the income statement is $3,500 — that stays the same, since it’s a total amount, not a specific account.

Additions to Cash

- Depreciation is included in expenses for the month, but it didn’t actually impact cash, so we add that back to cash.

- Accounts payable increased by $5,500. That’s a liability on the balance sheet, but the cash wasn’t actually paid out for those expenses, so we add them back to cash as well.

Decreases to Cash

- Accounts receivable increased by $4,000. That’s an asset recorded on the balance sheet, but we didn’t actually receive the cash, so we remove it from cash on hand.

Our net cash flow from operating activities adds up to $5,500.

Greg purchased $5,000 of equipment during this accounting period, so he spent $5,000 of cash on investing activities.

Greg didn’t invest any additional money in the business, take out a new loan, or make cash payments towards any existing debt during this accounting period, so there are no cash flows from financing activities.

Cash Flow for Month Ending July 31, 2019 is $500, once we crunch all the numbers. Greg started the accounting period with $5,500 in cash. After accounting for all of the additions and subtractions to cash, he has $6,000 at the end of the period.

Cash flow statements are powerful financial reports, so long as they’re used in tandem with income statements and balance sheets. See how all three financial statements work together.

Related Posts

What is an Invoice? (Example and Template)

Invoicing is the bread and butter of your business. Literally: If you don’t invoice, you don’t get paid, and you can’t afford bread or butter.

The Basics of Small Business Accounting: A How-to

New to business? Learn the fundamentals of small business accounting, and set your financials up for success.

How to Do Accounting for a Small Business: Your Quick-Start Guide

Learn how to handle your small business accounting and get the financial information you need to run your business successfully.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

Cash Flow Statement (CFS) Preparation

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on May 12, 2023

Fact Checked

Why Trust Finance Strategists?

Table of Contents

Cash flow statement: definition.

A cash flow statement (CFS) is a financial statement primarily intended to provide information about the cash receipts and cash payments of a business during the period of time covered by the income statement .

It is vital to keep track of cash flows on a continuing basis in order to keep a business healthy.

To Understand Cash Flow, Let’s First Understand "Cash"

Cash is a company’s most liquid asset; it is the lifeblood of operations. Without adequate cash, and regardless of the long-term assets that may be owned, a business cannot pay employees, creditors, taxes, dividends , or expenses .

So, it naturally follows that investors, creditors, and other interested parties would want to know as much as possible about a company’s cash receipts and cash payments.

The cash flow statement (CFS) shows much more about cash than do other financial statements.

For example, the balance sheet simply reports how much cash is held as of a specific date.

By comparing cash as reported on a current balance sheet with cash as reported on the balance sheet at the end of the preceding year, we can see how much cash changed—but not why it changed.

The statement of cash flows analyzes cash receipts and payments to show how cash was acquired and spent during the accounting period.

Cash Flow Statement: Explanation

A company’s cash flow statement shows the movement in cash items that takes place over a given financial period.

The aim of preparing a cash flow statement is to reconcile the company’s opening cash position with its closing cash position.

This is achieved by providing a fairly detailed—and itemized—list of sources from which additional cash was generated during the period and the use to which such cash was put.

A secondary objective of the statement of cash flows is to provide information about the financing and investing activities of a business. This statement shows various causes of variances in cash balance.

Like the fund flow statement , this statement also shows the inflow and outflow of cash between two time periods—generally from January to 31 December.

A statement of cash flows must be included in all financial reports that contain both a balance sheet and an income statement.

The cash flow statement replaced the statement of changes in financial position as the fourth required financial statement.

Cash flow reflects only the total cash inflow and closing cash at the end of the accounting period. As such, it speaks about the short-term financial positions of a company.

It focuses on the speed of cash being collected from debtors, stock , and other current assets , as well as the use of cash in paying current liabilities .

A cash flow statement is a brief statement that shows:

- The total amount of cash held at the beginning of the year (in the form of cash in hand, cash at bank, short-term investments , etc.)

- The total amount of cash held at the end of the year (in the form of cash in hand, cash at bank, short-term investments, etc.)

- Net increase or decrease recorded in the cash balances over the year—this is the difference between the above two figures

A cash flow statement is also a detailed statement that shows:

- All sources from which cash was generated during the year

- All uses made of cash during the year

- Net cash flow generated during the year (i.e., the difference between the above two lists)

- The net increase or decrease in the first statement should be equal to the net cash flow disclosed by the second statement

Classification of Cash Flows

The statement of cash flows is classified into the following three separate categories of cash flows:

- Cash flows from operating activities

- Cash flows from investing activities

- Cash flows from financing activities

Steps to Prepare the Cash Flow Statement

The procedure is the same as with a fund flow statement. The left-hand side records various sources of cash inflows and the right-hand side records the use or outflows of cash.

1. Cash inflows: Opening cash, cash from operations, issue of share capital, issue of debentures , issue of long-term loans, sales of fixed assets, and capital profits ( profit on the sale of fixed assets)

2. Cash outflows: Cash lost in operations, redemption of preference shares, redemption of debentures, repayment of long-term loans, purchase of fixed assets for cash, and payment of liabilities .

Format/Specimen of Cash Flow Statement

Objectives of the cash flow statement.

The main objectives of the cash flow statement are to provide information and knowledge about the following key areas:

1. Knowledge of cash inflows and outflows: The cash flow statement shows the various sources of cash inflow into the businesses, as well as where cash has been applied.

2. Knowledge of trading profits: The statement offers insights into how cash is generated and where it is being used, as well as what the balance is and whether it is in excess or not.

3. Knowledge of increase or decrease in share capital: The cash flow statement highlights the changes in share capital (whether it has increased or decreased).

4. Knowledge of purchase or sale of fixed assets: The statement provides useful information about the purchase or sale of fixed assets.

5. Knowledge of increase or decrease in long-term loans: The statement shows why long-term loans were raised or, if a loan is paid, what the source of the payment was.

6. Knowledge of increase or decrease in cash balance: The statement highlights the exact position of whether the cash in the business has increased or decreased over a specific period.

7. Knowledge of tax and dividends paid: This statement is useful in helping to learn about the amount that a business usually pays for taxes and dividends.

From the following balance sheet of Star Mills Ltd., prepare a cash flow statement.

Additional information is given as follows:

- Dividends paid during the year: $46,000

- Depreciation on written-off machinery: $28,000

- Provision for taxation: $66,000

Cash from operations

Cash flow statement

Working notes

1. Tax paid

2. Machinery purchased

3. Business premises

Cash Flow Statement (CFS) Preparation FAQs

What is a cash flow statement.

A Cash Flow statement (CFS) is a Financial Statement primarily intended to provide information about the cash receipts and cash payments of a business during the period of time covered by the income statement.

What are the classifications of cash flows?

The statement of Cash Flows is classified into the following three separate categories of Cash Flows: Cash Flows from operating activities, Cash Flows from investing activities and Cash Flows from financing activities.

What is in cash flow?

Cash inflows: Opening cash, cash from operations, issue of share capital, issue of Debentures, issue of long-term loans, sales of Fixed Assets, and capital profits (profit on the sale of Fixed Assets)

What is cash outflow?

Cash outflows: Cash lost in operations, redemption of preference shares, redemption of Debentures, repayment of long-term loans, purchase of Fixed Assets for cash, and payment of liabilities

What are the objectives of the cash flow statement?

The main objectives of the Cash Flow statement are to provide information and knowledge about the following key areas: Knowledge of cash inflows and outflows, Knowledge of trading profits, Knowledge of increase or decrease in share capital, Knowledge of purchase or sale of Fixed Assets, Knowledge of increase or decrease in long-term loans, Knowledge of increase or decrease in cash balance and Knowledge of tax and dividends paid.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Adjusted Net Profit

- Cash Flow From Financial Activities

- Cash Flow From Investing Activities

- Cash Flow From Operating Activities

- Cash Flow Statement: Practical Problems and Solutions

- Difference Between Profits and Cash Flows

- How to Prepare a Statement of Cash Flows

- Non-Cash Expenses

- Non-Cash Incomes

- Reporting Cash Flows From Operating Activities

- Sources of Cash

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch with a financial advisor, submit your info below and someone will get back to you shortly..

- Search Search Please fill out this field.

What Is Cash Flow?

- Formula & Calculation

Understanding Cash Flow

Cash flow statement, types of cash flow, how to analyze cash flows, example of cash flow, the bottom line.

- Corporate Finance

Cash Flow: What It Is, How It Works, and How to Analyze It

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Cash flow is the movement of money into and out of a company over a certain period of time. If the company's inflows of cash exceed its outflows, its net cash flow is positive. If outflows exceed inflows, it is negative. Public companies must report their cash flows on their financial statements. This information can be of great interest to investors as an indicator of a company's financial health, especially when combined with other data.

Key Takeaways

- Cash flow is the movement of money in and out of a company.

- Net cash flow is calculated by subtracting total cash outflow from total cash inflow.

- A company's cash flow statement reports its sources and use of cash over a certain period of time.

- Cash flow can be categorized as cash flows from operations, from investing, and from financing.

Investopedia / NoNo Flores

Formula and Calculation of Cash Flow

You can easily calculate a company's net cash flow using this formula:

NCF = TCI - TCO

- TCI = Total cash inflow

- TCO = Total cash outflow

Cash flow refers to the money that goes in and out of a business. Businesses take in money from sales as revenues (inflow) and spend money on expenses (outflow). They may also receive income from interest, investments, royalties , and licensing agreements and sell products on credit rather than for immediate cash. Assessing cash flows is essential for evaluating a company's liquidity , flexibility, and overall financial performance.

Positive cash flow indicates that a company's liquid assets are increasing, enabling it to cover obligations, reinvest in its business, return money to shareholders, pay expenses, and provide a buffer against future financial challenges. Companies with strong financial flexibility fare better, especially when the economy experiences a downturn, by avoiding the costs of financial distress .

Cash flows are reported on a cash flow statement , which is a standard financial statement that shows a company's cash sources and use over a specified period. Corporate management, analysts, and investors use this statement to judge how well a company is able to pay its debts and manage its operating expenses. The cash flow statement is one of several financial statements issued by public companies, which also include a balance sheet and an income statement .

The cash flow statement acts as a corporate checkbook to reconcile a company's balance sheet and income statement. The cash flow statement includes the bottom line , recorded as the net increase/decrease in cash and cash equivalents (CCE) .

The bottom line reports the overall change in the company's cash and equivalents over the last period.

Cash Flows From Operations (CFO)

Cash flow from operations (CFO) describes money flows involved directly with the production and sale of goods from ordinary operations. Also known as operating cash flow or OCF , as well as net cash from operating activities, CFO indicates whether or not a company has enough funds coming in to pay its bills or operating expenses .

It is calculated by taking cash received from sales and subtracting operating expenses that were paid in cash for the period.

Cash Flows From Investing (CFI)

Cash flow from investing (CFI) or investing cash flow reports how much cash has been generated or spent from various investment-related activities in a specific period. Investing activities include purchases of speculative assets , investments in securities, or sales of securities or assets.

Negative cash flow from investing activities might be due to significant amounts of cash being invested in the company, such as research and development (R&D) , and is not always a warning sign.

Cash Flows From Financing (CFF)

Cash flows from financing (CFF) shows the net flows of cash used to fund the company and its capital. CFF is also commonly referred to as financing cash flow . Financing activities include transactions involving the issuance of debt or equity, and paying dividends.

Cash flow from financing activities provides investors with insight into a company's financial strength and how well its capital structure is managed.

Using the cash flow statement in conjunction with other financial statements can help analysts and investors make informed decisions and recommendations. Often-used measures include:

Below is Walmart's ( WMT ) cash flow statement for the fiscal year ending on Jan. 31, 2024. All amounts are in millions of U.S. dollars.

Walmart's investments in property, plant, and equipment (PP&E) and acquisitions of other businesses are accounted for in the cash flow from investing activities section. Proceeds from issuing long-term debt, debt repayments, and dividends paid out are accounted for in the cash flow from financing activities section.

Walmart's cash flow was positive, showing a net increase of $1.09 billion, which indicates that it retained cash in the business and added to its reserves to handle short-term liabilities and fluctuations in the future.

How Are Cash Flows Different From Revenues?

Cash flow refers to the amount of money moving into and out of a company, while revenue represents the income the company earns on the sales of its products and services.

What Is the Difference Between Cash Flow and Profit?

Again, cash flow simply describes the flow of cash into and out of a company. Profit is the amount of money the company has left after subtracting its expenses from its revenues.

What Is Free Cash Flow and Why Is It Important?

Free cash flow is the money left over after a company pays for its operating expenses and any capital expenditures. Companies are free to use FCF however they choose to. Free cash flow is considered an important measure of a company's profitability and financial health.

Why Is the Price-to-Cash Flows Ratio Used?

The price-to-cash flow (P/CF) ratio compares a stock's price to its operating cash flow per share. P/CF is especially useful for valuing stocks with a positive cash flow but that are not profitable because of large non-cash charges .

Do Companies Need to Issue a Cash Flow Statement?

Yes, in the case of public companies . Cash flow statements have been required by the Financial Accounting Standards Board (FASB) since 1987.

Cash flow refers to money that goes in and out of a business. Companies with a positive cash flow have more money coming in than they are spending. However, cash flow alone can sometimes provide a deceptive picture of a company's financial health, so it is often used in conjunction with other data.

U.S. Securities and Exchange Commission. " Beginners' Guide to Financial Statements ."

United States Securities and Exchange Commission. " Form 10-K: Walmart Inc. ," Page 58.

Financial Accounting Standards Board. " Summary of Statement No. 95 ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-592232681-da0ca73d27994f0085bc3bda0ce50c30.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Ford Motor Company: Cash Flow Statement Words: 586

- Cash Flow as Business Performance Measure Words: 387

- Formula of Incremental Cash Flow Words: 285

- Cash Flow Statement as a Reflection of Financial Health Words: 601

- Requirement to Produce Income and Cash Flow Statement Words: 2644

- Differentiating Cash Flow and Profit in Business Accounting for Financial Clarity Words: 581

- Cash Flow Statements in Business Words: 281

- Apple Inc.’s and Microsoft Corporation’s Cash Flow Indicator Words: 932

- Financial Constraints and Investment Cash Flow Sensitivity Words: 3949

- Construction Management: Organizations, Cash Flow & Controls on Site Words: 3009

- The Cash Flow Concept and Calculation Methods Words: 394

Cash Flow Management: Definition

The relevance of the topic regarding cash flow management remains essential in the modern market. Sustainable profit is the main source that contributes to the proper functioning and development of any company as well as a stable financial position. According to researchers, cash flows can be defined as “the amount of cash that a business entity owns and which ensures its efficiency, financial stability, solvency, liquidity, and image” (Soboleva et al., 2018, p. 2035). In other words, it is a set of receipts and payments that are generated by a company’s activities, a dynamic movement of money over time.

In the field of financial studies, considerable attention is paid to the primary purpose of cash flow management. First of all, cash flow is both an influential factor and a consequence of all economic activities of the enterprise in many aspects. Effectively organized financing of a company is one of the most important symptoms of its economic condition. Moreover, it can also be considered a prerequisite for achieving benefits and high results of business performance in general.

Rational formation of cash flows contributes to the process of the implementation of any new policies in a firm. Any failure to gather revenue and to make necessary payments negatively affects several activities, including purchasing raw materials. Furthermore, the financial situation of an enterprise seriously affects the level of labor productivity. For this reason, researchers note that any activity “requires spending money and should be conducted in such a way as to ensure sufficient financial flows” (Sula, 2015, p. 74). By actively and effectively managing cash flows, it is possible to ensure more rational and economical use of a firm’s financial resources that are generated from internal sources. Therefore, it would be easier to reduce the dependence of the enterprise’s development rate on investments from the outside. Negative cash flows demonstrate unfavorable financial health and repel possible investors, where, on the contrary, satisfactory cash flow rates validate and secure a company’s position in the marketplace. Therefore, by ensuring a stable financial status, more assurance is created for the enterprise’s ability to pay its full expenses.

In addition, the factor of cash flow should be taken into account when assessing financial conditions of a company, since it is an important financial lever that can guarantee the acceleration of the capital turnover of the enterprise. By developing the flow of money through effective management, a company can increase the amount of profit generated over time. Proper synchronization of cash receipts and payments can be achieved during the process of managing, which in the long run, eliminates the factor of bankruptcy and is another determinant considered by analysts. Predicting possible future revenue and payments can be conducted in the form of analytical tables. After analyzing the number of net cash flows, necessary measures should be taken to optimize cash management in a company as in that way a specialist is able to provide a full idea of company’s financial state.

In 2012, Ford Motor Company released a report that contained information about changes in its financial situation. In general, the firm indicates that “execution of One Ford plan has generated significant positive automotive operating-related cash flow in recent years” (Ford Motor Company, 2012, p. 18). In order to be specific, it must be noted that by 2012 the gross cash has raised up to 24.3 billion dollars from 20.5 billion dollars in 2010 (Ford Motor Company, 2012). Moreover, even though their capital expenditures have also grown from 4,092 million dollars in 2010 up to 5,488 million dollars, the amount of short-term debt reduced. These outcomes suggest that while the spending of the company significantly increased during these two years, Ford still managed to generate positive cash flow.

Stable cash flow of the company is a determinant of company’s stability on the marketplace. Cash flow statements are of great importance while assessing a company’s financial status. A new approach to financial plan execution by Ford Motors is a prominent example of a significant improvement of cash flows in the short span of time, which must not be overlooked.

Ford Motor Company. 2012 Annual report – Profitable growth for all, Ford Motor Company [PDF document]. Web.

Soboleva, Y. P., Matveev, V. V., Ilminskaya, S. A., Efimenko, I. S., Rezvyakova, I. V., & Mazur, L. V. (2018). Monitoring of businesses operations with cash flow analysis. International Journal of Civil Engineering and Technology , 9 (11), 2034-2044.

Sula, V. (2015). Cash flows management at the enterprise level. Economie şi Sociologie , (1), 74-77.

Cite this paper

- Chicago (N-B)

- Chicago (A-D)

StudyCorgi. (2022, February 16). Cash Flow Management: Definition. https://studycorgi.com/cash-flow-management-definition/

"Cash Flow Management: Definition." StudyCorgi , 16 Feb. 2022, studycorgi.com/cash-flow-management-definition/.

StudyCorgi . (2022) 'Cash Flow Management: Definition'. 16 February.

1. StudyCorgi . "Cash Flow Management: Definition." February 16, 2022. https://studycorgi.com/cash-flow-management-definition/.

Bibliography

StudyCorgi . "Cash Flow Management: Definition." February 16, 2022. https://studycorgi.com/cash-flow-management-definition/.

StudyCorgi . 2022. "Cash Flow Management: Definition." February 16, 2022. https://studycorgi.com/cash-flow-management-definition/.

This paper, “Cash Flow Management: Definition”, was written and voluntary submitted to our free essay database by a straight-A student. Please ensure you properly reference the paper if you're using it to write your assignment.

Before publication, the StudyCorgi editorial team proofread and checked the paper to make sure it meets the highest standards in terms of grammar, punctuation, style, fact accuracy, copyright issues, and inclusive language. Last updated: February 16, 2022 .

If you are the author of this paper and no longer wish to have it published on StudyCorgi, request the removal . Please use the “ Donate your paper ” form to submit an essay.

IMAGES

VIDEO

COMMENTS

The cash flow statement is a mandatory part of a company's financial reports, it records the amounts of cash and cash equivalents entering and leaving the company. The cash flow statement analyzes the cash income and expenditures during a financial period and it has three parts which show the variations in the firm's cash flows including ...

The specific aspect, which distinguished cash flow from other financial statements, is that it does not reflect noncash operations. For instance, depreciation would not be included in such report. Additionally, it is especially crucial for small businesses to calculate their cash flow on a quarterly basis ("Cash flow statement," n.d.).

Cash flow statements help in tracing the various sources of cash such as operations, sales of current and fixed assets, issuance of share capital, and borrowed income. Further, it shows cash outflows, including the purchase of existing and fixed assets, the redemption of debentures, and preference shares, among other expenses (Klammer, p. 200).

250 Words Essay on Cash Flow Understanding Cash Flow. Cash flow is the money that comes in and out of a business or a person's pocket. Think of it like water in a river. Money flows in from things like sales of products or getting an allowance, and it flows out when bills are paid or when you buy something. ...

Learn the definition of a cash flow statement as well as how it is structured and calculated. Also included are an example and insight into its importance. ... Importance of a Cash Flow Statement. The CFS is one of the most important financial statements for a business. Cash is the lifeblood of any organization, and a company needs to have a ...

Cash flow, income and expenses, provides the key to financial responsibility. It is the difference between future happiness and future misery. The decisions we make today--to run a surplus or a ...

Cash Flow from Operating Activities is cash earned or spent in the course of regular business activity—the main way your business makes money, by selling products or services. Cash Flow from Investing Activities is cash earned or spent from investments your company makes, such as purchasing equipment or investing in other companies.

Cash Flow Statement: Definition. A cash flow statement (CFS) is a financial statement primarily intended to provide information about the cash receipts and cash payments of a business during the period of time covered by the income statement. It is vital to keep track of cash flows on a continuing basis in order to keep a business healthy.

Cash flows are reported on a cash flow statement, which is a standard financial statement that shows a company's cash sources and use over a specified period. Corporate management, analysts, and ...

This paper, "Cash Flow Management: Definition", was written and voluntary submitted to our free essay database by a straight-A student. Please ensure you properly reference the paper if you're using it to write your assignment.